The following is an excerpt from the quarterly newsletter distributed to clients.

2023: I beg your pardon, I never promised you a recession

2023 was another wild and unprecedented year in the investment world. To paraphrase Voltaire, we have seen so many extraordinary things in the past ten years that nothing seems extraordinary anymore.

Although most markets and asset classes registered gains, 2023 did not “feel” like a good year for the average Canadian. Economic conditions, while improving, remain difficult for many households across the country. Moreover, market mood was generally dour. One would almost be forgiven for missing what was otherwise an excellent year by historic standards for performance in equities – the S&P 500 was up 24%! – and a decent one for bonds.

Against this backdrop, Focus investment strategies performed well across the board, with all investment strategies meaningfully outpacing their benchmarks. We attribute this robust performance to a sound, value-based philosophy and employing a bottom-up, security by security approach. This contrasts markedly from what we see as a growing trend for individual investors to speculate on “macro” events like the timing of recessions or market crashes.

What lessons can we take from this strange year? To start, there are no investment crystal balls and one should always step back when everyone agrees.

To illustrate this point, recall the uncertain mood with which we began this past year, and how poorly most investments included, declined by 18% in 2022 while the US bond market lost over 15% – one of the worst annual results for traditional balanced portfolios on record. As 2023 dawned, investors perceived dark clouds on the horizon in the form of inflation, US political strife (government shutdowns), escalating wars and especially, the spectre of impending recession. Pessimism regarding the economy was rampant. In fact, sentiment was so negative, in late 2022, two surveys – one conducted by the University of Chicago Booth School of Business in partnership with the Financial Times, the other by Bloomberg – indicated that 100% of the economists polled were predicting a recession within one year.

100%! A simply unprecedented (and eyebrow raising) level of certainty and agreement.

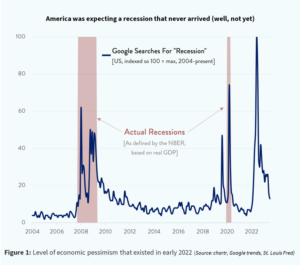

And as economist prognostications radiated outwards to the masses through the business press, the average citizen soon came under the influence of the experts. Chart 1 illustrates the level of economic pessimism that existed in early 2022: Google searches for the term “Recession” skyrocketed, surpassing relative heights from the two most recent, actual, bonafide recessions (2008/09 and early 2020).

So, when 2023 rolled around, many investors, professional and amateur alike, assumed the upcoming year would bring nothing but challenges for investment portfolios. And again, there were reasons for pessimism (back then central banks around the world were signaling their respective intentions to bring down inflation at all costs, efforts that have historically triggered recessions). But the recessions never came. Instead, something unexpected happened.

Inflation began falling quickly while the economy and employment held firm. Equity markets rallied.

Looking back on these results, it’s worth making three observations.

First, the economy is a complex adaptive system in which many paths may unfold. It is difficult to make quality predictions in systems like this. Lately, our team has wondered whether the unique nature of the once-in-a-hundred-year pandemic has perhaps upended some of the usefulness of the economists’ historical analogues. Perhaps the global economy, a complex system of trillions of daily interactions between billions of individuals, still has some lessons in humility to impart.

“The S&P500 has merely recouped the losses from 2022 in 2023. Returns from the last two years are flat.”

Second, and related, this is why investment approaches should never be based on prognostication. 2023 turned out to be better than feared. Unfortunately, we get the sense that many investors succumbed to the pessimism of early 2022 and altered or abandoned their long-term investment plans. Trying to time the market almost always proves costly.

Third, a sound investment philosophy is one in which capital can grow under a wide variety of investment conditions. This is why Focus continues to diligently pursue real diversification opportunities for our clients in 2024 and beyond. 2022 and 2023 both showcased why these efforts matter.

Investment Strategies

The following is a brief recap of the individual Focus investment strategies for the full year 2023.

Public Equities

Summary: Returns have been strong for the two Focus equity funds (and well in excess of their benchmarks) due to opportunities away from the broad market averages. In North America, we prefer less-followed, mid-sized companies while internationally, we like high-quality dividend-paying stocks, which are attractively valued and seem to have awoken from a 15-year period of underperformance relative to US markets.

Global equity market indices experienced a better-than-expected 2023, driven by a powerful rally into year end. Investors seem to be welcoming the prospect of lower interest rates once more; expectations which buoyed equity valuations. The S&P500 registered an impressive 26.3% return in 2023 (23.7% in CAD).

With that said, it’s worth making three observations:

- The S&P500 has merely recouped the losses from 2022 in 2023. Returns from the last two years are flat.

- Over half of the S&P500’s return for 2023 was attributable to the “Magnificent 7” – a group of technology stocks consisting of Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla. These 7 stocks now comprise nearly one-third of the entire S&P 500 market capitalization. The S&P 500 Equal Weight Index, a better measure of how the average stock performed, rose by a more modest 13.9%.

- The Canadian market, lacking exposure to heavyweight technology names, saw performance closer to the Equal Weight S&P500. The S&P/TSX gained 11.8% on a total return basis during the year and is also flat over two years.

Within this environment, the Focus Core Equity Fund is finding opportunities across sectors and sizes in North America. For example, we deployed capital into the technology sector late last year, including some of the companies above, after many of them had fallen by 30-40%. However, the strong move in technology stocks this year has put them back in “expensive looking” territory. Positive investor sentiment towards this group (and much of the sector) also leaves little margin of safety. We do have exposure to the tech sector, but currently in smaller, less-followed companies.

Core Equity is finding opportunities in mid-sized companies. Unlike many of the “mega-cap” companies, there are plenty of mid-sized, mid-cap stocks that trade at attractive valuations, while also having strong business models, healthy balance sheets and ample free cash flow, which should help them weather and potentially capitalize on difficult economic conditions. The primary driver of returns for these stocks continues to be company performance, not the Fed, interest rates or positioning of hedge funds. This is where we spend most of our time looking for investments.

The other interesting aspect of these companies is optionality around M&A. Their size and characteristics – dominant competitive positioning, high returns on capital, strong free cash flow – make them particularly attractive to Private Equity (“PE”) firms, with many trading at valuations well below those on offer in the private market. With PE firms sitting on record amounts of “dry powder” they need to invest, and with interest rates having leveled off after a period of intense volatility, we expect to see a continued increase in public companies being taken private. Indeed, Focus had three such privatizations in the fourth quarter. While it can be frustrating having to replace a great portfolio company, the significant acquisition premiums (typically 40-60%) are an excellent source of returns that are independent of and uncorrelated with “the market.”

“A large source of returns for Focus in recent years has been our willingness to use the liquidity of public equity markets to our advantage.”

Outside of North America, we have seen very strong returns in the Focus (Int’l) Dividend Equity Fund since we made a concerted shift towards international stocks in mid-2022. Notwithstanding the performance, international stocks still trade at a meaningful discount to North American stocks, and we continue to advocate for clients to have exposure to high quality, non-North American equities.

For instance, UK stocks look particularly interesting. The UK economy has experienced a perfect inflationary storm due to a combination of supply chain pressures, COVID-driven labour shortages, and record-high increases in energy and food costs due to the war in Ukraine. Combined with lingering Brexit-related impacts, the FTSE 100 saw a total return of just 4% in 2023 after a flat 2022. Today, the UK market offers a dividend yield nearly three times that of the S&P 500 (4% vs. 1.4%). Additionally, the FTSE 100 is currently trading more than 25% below its historical average price to earnings ratio (P/E) of 15x.

Mexico has been another area of opportunity. Globally, increased tensions between the US and China have led to a wave of manufacturing activity moving from Asia to Mexico to reduce supply chain risk and keep production costs low. As more and more companies opt to “near-shore” (return their supply chains to North America) many local Mexican industries and companies should benefit. Some examples of attractive opportunities include Mexican commercial construction firms (construction output was up by 46% in 2023), as well as Mexican industrial REITs due to increased demand for industrial real estate space. We believe that Mexico presents attractive long-term investment opportunities due to an expanding labour force, increasing foreign investment, and a more dominant position in the global manufacturing landscape.

In summary, the last two years in equity markets have been very volatile, with many investment managers being wrongfooted by the volatility and numerous crosscurrents. Although the US and Canadian stock markets are up only marginally over where they stood two years ago, very few managers have matched even those lacklustre returns. Sticking to sweet spots of mid-sized North American, and attractively valued international companies has resulted in a much better experience than the broad market averages with far less volatility.

Speaking of volatility – we expect it may continue. But a large source of returns for Focus in recent years has been our willingness to use the liquidity of public equity markets to our advantage. In other words, if an investment thesis works out earlier than expected, a value discipline suggests being willing to take profits to redeploy into better opportunities.

Public Fixed Income

Summary: The last three years have been the most challenging period for bonds in living memory. Fortunately, the two Focus fixed income strategies have avoided the carnage and are now poised to benefit from a yield environment that hasn’t been this robust in years.

Following the fastest interest rate tightening cycle in 40-years (+450 basis points by the Bank of Canada and +525basis points by the Fed), we believe rates have likely peaked, although it is unlikely that central banks return to zero or “near-zero” interest rates in the foreseeable future. Still, the savage, three-year bear market in bonds may be over. Inflation has moderated faster than expected, declining from a peak of 8% in June 2022 to 3% currently, largely owing to a moderation in energy prices and supply chain normalization. The current outlook for bonds has greatly improved and we are therefore comfortable taking more duration exposure.

After sidestepping multiple years of bond market losses, the Focus Fixed Income Fund now has high visibility towards a 4.5% yield for a duration of 8 years. Furthermore, conservative bonds have now regained their diversifying characteristics for portfolios. For example, if the economy does go into recession, many of the bonds in the fund could appreciate significantly in value, providing a counterweight to potential losses in other parts of client portfolios (such as stocks). The fund’s duration measure will fluctuate based on our market views. For context, duration has been as low as 1 year when interest rates were still at cycle-lows in mid-2020, and as high as 11 years at their peak this past October.

Although there is much speculation about when the US Fed may start to cut interest rates, it is possible that the Bank of Canada (BoC) begins cutting rates first. We believe the Canadian economy has become more sensitive to interest rates than the US due to the size and state of the Canadian housing market. A recent report from a Canadian bank stated that 60% ($900bln) of outstanding mortgages at Canadian banks will be due for renewal between 2024-2026. With the average Canadian mortgage rate at 6.5% currently, borrowers will see a significant increase in housing costs upon renewal. This could motivate the BoC to cut rates earlier than expected, as an increase in forced home sales would result in material downward pressure on home prices and discretionary consumer spending.

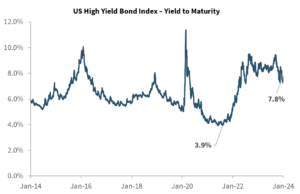

With respect to the Focus Credit Opportunities Fund, the setup is promising as yields on non-investment grade bonds have more than doubled since early 2022. As Figure 2 illustrates, the broad US high-yield credit market was recently trading at a 10% yield to maturity (versus ~4% in 2022). When compared to the historical S&P500 annual return of 10%, we believe a properly curated portfolio of high-yield credit offers investors highly attractive risk-adjusted, equity-like returns with far lower risk. Recall, one of the most appealing aspects of credit is the ranking of bonds in the capital structure, leading to bond holders being repaid first should a credit event occur. (See Spotlight on Hawaiian Airlines for an example of a recent bond investment)

Spotlight on Credit Investing

Investment Thesis – Hawaiian Airlines bonds

We often get asked about how we invest in the Focus Credit Opportunities Fund. The following is an example using Hawaiian Airlines, which was severely impacted by numerous “black swan” events, including the COVID-19 pandemic and the Maui wildfires of August 2023. The company was also disrupted by engine delivery delays on new plane orders.

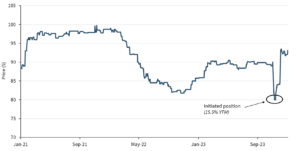

As a result, the firm’s profitability outlook was sharply reduced, causing the share price to decline by more than 90% and outstanding bond issues to fall by more than 20%. At the time of investment, these bonds, which carried a contractual obligation to be redeemed in 24 months, had a yield to maturity of 15% per year.

Our internal diligence identified Hawaiian Airlines as a company displaying encouraging momentum with passenger volumes and bookings, substantial progress in a return to profitability, and a highly attractive balance sheet with more than $1.3bln of total liquidity, more than enough to retire all outstanding debt. We also recognized Hawaiian Airlines as a potential acquisition target due to the depressed share price, highly valuable Pacific air route authority, and the M&A capacity of airline peers. On December 3, 2023, Alaska Airlines announced an agreement to acquire Hawaiian Airlines for a large premium. Our bond position subsequently appreciated by 11%, in addition to the 3.9% annual coupon. We expect the bonds to eventually be retired at par, further increasing the return on our position.

Although stock markets have been very strong of late, corporate credit markets are still reflecting a decent amount of pessimism towards the economy. Furthermore, the Canadian credit markets suffer from a lack of liquidity and are particularly inefficient. We believe these conditions present a wealth of attractive investment opportunities in 2024 for nimble credit investors.

Finally, in addition to Credit Opportunities’ attractive yield to maturity, the tax treatment of those returns is currently favourable. Given the losses experienced in fixed income markets over the last three years, many bonds are trading at large discounts to their par value. If interest rates fall (and bond prices rise), the resulting appreciation will be classified as capital gains which are taxed at a significantly lower rate than the typical interest income received from bonds.

Balanced Strategy – The Focus Fund

Summary: A strong return in 2023, and healthy performance when compared to the peer group of balanced funds. The Focus Fund incorporates all the Focus investment strategies to deliver a truly diversified, “endowment-style” portfolio. This differentiated approach to asset mix has resulted in strong absolute and relative returns in a challenging investment environment.

The Focus Fund appreciated by 12.6% (before fees) during 2023, which compares to an average gain of 7.4% for the peer group of similar Canadian balanced funds, as reported by the fund-rating firm Morningstar. The Fund has experienced a strong multi-year period of returns, registering first quartile performance over one-, three- and five-year periods as per Morningstar.

The fund’s strong returns relative to its benchmark can be attributed to significant outperformance of its underlying individual investment strategies (Core Equity & International Dividend Equity, Fixed Income, Credit Opportunities) and more recently, the inclusion of the Focus alternative strategies. The goal of this asset mix evolution is to enhance investment returns and lower volatility in what may prove to be a challenging investment environment going forward.

Alternative Investment Strategies

Alternatives include asset classes other than traditional stocks and bonds. In the case of private investments such as infrastructure and real estate, they are not traded on public exchanges and therefore have less liquidity. The difficult market environment of 2022 tested the resiliency of the Focus alternative strategies with the private funds posting strong positive returns. So far in 2023, a recovery year for stocks and bonds, the alternative strategies have kept pace. We view our alternatives as valuable “tools in the toolbox” that should help us deliver more consistent returns during challenging investment environments in the future.

Focus Infrastructure & Real Assets LP

Summary: The Fund has returned 18.5% through the first three quarters of 2023 (private fund reporting occurs with a three-month lag). This follows a positive 8.6% return in 2022, a year which saw the S&P500 and the TSX decline by 18% and 6%, respectively.

This fund invests in assets that have value because they are often essential to the daily functioning of the economy, such as renewable power, transportation, logistics, communications and data infrastructure, and energy storage.

Our partners pursuing the mid-market infrastructure space have generated strong results year to date as the cash flows of their underlying projects have been unaffected by the volatile business environment. Another partner targeting student housing opportunities has managed to avoid the disruptions in the real estate sector through continued operating income growth and disciplined capital allocation.

Focus Private Debt LP

Summary: The fund has returned 7.1% through the first three quarters of 2023. This follows a positive 9.4% return in 2022, a year which saw double-digit declines for public fixed income benchmarks.

Private debt refers to loans negotiated directly with companies or individuals, real estate lending, working capital loans and trade finance. We focus on shorter term, floating-rate debt with significant security in terms of claims on underlying assets or cash flow.

The sector continues to benefit from some of the highest yields in over a decade, with borrowers adapting well to macroeconomic challenges. Amid moderating inflation and sustained strength in the labour market, private debt continues to deliver compelling risk-adjusted returns. Yields on new senior loans are pricing at 12%+. Default rates on mid-market issuers remain significantly below previous periods of economic stress, such as 2008/2009.

Focus Absolute Return Fund

Summary: A 2.9% return for the eleven months ending November 30, 2023. Expected to deliver mid to high single-digit, uncorrelated returns, the fund was positive during months when markets were negative in 2023.

The outlook for the fund is positive and the reasons for exposure to the strategy are unchanged – portfolio protection when markets take a turn for the worse. The fund aims to deliver mid to high single-digit returns with low volatility and little to no sensitivity to the direction of equity or bond markets. The fund has allocated capital to external partners that employ specialized strategies to generate uncorrelated returns by exploiting inefficiencies in liquid financial markets. These strategies include merger or risk arbitrage, convertible arbitrage and long/short equity, among others.

Focus Private Real Estate LP (New)

Summary: The newest Focus strategy launched Jan. 1st, 2024. We believe income-producing real estate has a place in well-diversified portfolios. By waiting until now to launch the strategy, Focus has avoided much of the pain experienced by real estate investors due to the substantial rise in interest rates. We now look forward to allocating capital to differentiated, value-added real estate over the next 12-24 months.

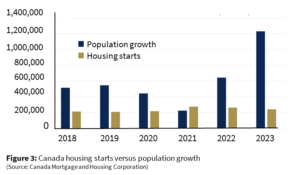

As is our usual practice when launching a new investment strategy, Focus has allocated to an institutional-class investment partner with a similar culture, a solid track record of success and a differentiated opportunity that our clients would have difficulty accessing themselves. Our anchor real estate investment partner is a firm we know well, having allocated to them in our Private Debt fund. They are one of Canada’s leading independent real estate investment management firms with a core competency in Canadian multi-residential real estate (apartment buildings). This initial foray into the Canadian multi-residential subsector seeks to capitalize on the positive supply and demand drivers apparent to all – immigration-driven demand and a chronic undersupply of housing in Canada (see Figure 3).

Parting thoughts / Look ahead

Montreal-born Harvard psychology professor, Steven Pinker once advised to “base your understanding of the world on data, rather than journalism. Journalism is a highly non-random sample of the worst things that have happened.” In both last quarter’s letter and this one, we have touched on the prevalence of negative news stories in modern media, and the deleterious effect subscribing to such gloom can have on investment returns. Modern media is increasingly negative and hyperbolic. It inflames the worst of investor irrationality.

Any investor can see the world suffers from its share of problems right now. The real question is not whether there are risks (there are, and always are); it is how well these risks are factored into asset prices and valuations. To that question, the answer appears to be a mixed bag: while expectations for some companies, like the Magnificent 7, leave little room for error, others provide a wider margin of safety, and more attractive return profiles.

Overall, and despite returns for asset markets in 2023, negative sentiment appears to persist among investors. Nowhere is this more evident than the record $5.9 trillion that currently sits in money market funds (commonly referred to as “cash on the sidelines”). This amount of caution is not altogether surprising given the consensus story that emerged this year. However, and to Pinker’s point, the story does not necessarily fit the data.

Looking out into 2024, there are clear risks, but also a number of spots with attractive investment opportunities. Our team moves forward with a healthy dose of caution and a constructive view.