The following is an excerpt from the quarterly newsletter distributed to clients.

Q1 2024 – Return of Hype

Market mood rose in the first quarter of 2024. Between benign inflation and resilient economic performance in advanced market economies, investor optimism broadly improved. Central banks tried to temper the most aggressive of expectations, arguing the battle against inflation had not yet been won, though investors were not altogether convinced. Against this backdrop, major equity indices rallied worldwide, and bond market volatility was higher than equities. The S&P 50 was up 10.4% and the S&P/TSX 6.6%.

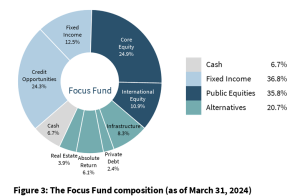

By far the most important theme has been the dominance of a handful of mega cap technology stocks related to Artificial Intelligence (AI). As this quarter closed the top ten largest U.S. companies now account for over one third of the S&P500’s market capitalization (see Figure 1). One third! In only two periods over the last 100 years – 1929 and 2000 – have there been comparable levels of concentrations (in both cases, the extreme concentration preceded a steep decline in equities). Meanwhile, Nvidia, the leading producer of semiconductors used in AI applications, was the major contributor to equity performance in the S&P 500, contributing over 20% to the gain.

“The top ten largest U.S. companies now account for over one third of the S&P500’s market capitalization.”

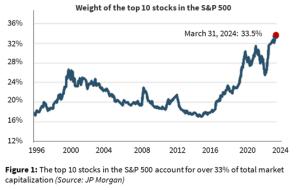

Whether artificial intelligence will now fall into the classic Gartner Hype Cycle remains to be seen. Regardless, current valuations leave little room for error. Valuations for the top 10 stocks in the S&P 500 are currently 26x price to earnings, compared to an average of 19x for the remaining 490 companies in the S&P500. While these levels are lower than they were in the peak of the 2000 bubble, they do not put the odds of success in the investor’s favour (Figure 2).

Diversified Strategy:

The Focus Fund

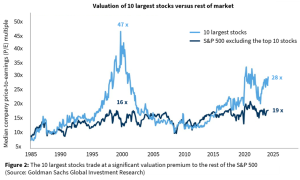

The Focus Fund incorporates all the Focus investment strategies to deliver a truly diversified, “endowment-style” portfolio. This differentiated approach to asset mix has resulted in strong absolute and relative returns over the last three years, despite the challenging investment environment — delivering an 8.6% annualized return versus the 3.0% of the benchmark Morningstar Canadian Tactical Balanced Index.

Stocks have had a good run of late, particularly in some growth and momentum areas like technology where we see sub-par returns going forward. Although we are not overly negative, cash reserves have risen while we wait for better opportunities to present themselves. The asset mix for the Focus Fund was as follows at the close of the first quarter:

Public Equities

During the first quarter, stock markets continued the rally that started on November 1st, 2023, when Jay Powell, Chairman of the US Federal Reserve (the Fed) signaled an end to the cycle of interest rate hikes. Since that time, the S&P500 has appreciated by over 25%, while the TSX is up over 15%. Clearly, the stock market is pricing in lower interest rates ahead.

“We believe in the companies we own and their ability to generate attractive returns over the next three to five years. This stands in stark contrast to “the market”.”

Unfortunately, this has left much of the market trading at all-time highs, at or near all-time high valuations. This is particularly true for anything remotely consistent with the theme of “high quality”. Although investing in high quality companies is a winning strategy over the long term, there are times when investors simply pay too high for a good business. Although the common belief is that this situation can only be resolved with a crash, more often than not, expensive stocks simply provide sub-par returns while overvaluation gets resolved by underlying earnings growth. In other words, earnings keep growing while the stock price can stay flat. This has occurred countless times throughout history and the odds of a repeat are high at the current time.

As noted above, ground zero for this phenomenon is US large capitalization, and especially, technology stocks related to artificial intelligence. Between Nvidia and other very large, AI-themed stocks like Microsoft and META (formerly Facebook), almost 40% of the 10.4% of the S&P 500’s gain during the first quarter was attributable to “AI mania”.

Meanwhile, in Canada, the 6.6% quarterly gain for the S&P/TSX was driven by another type of theme: energy and commodities. The oil & gas, mining and gold sectors combined accounted for over 50% of the index move during the quarter. The gains follow several years of lackluster returns for these commodity sectors, none of which figure too prominently in our core investment process. While commodities do periodically offer explosive returns, few companies in this sector have wealth-generating business models that produce returns on investment over their cost of capital over time. Over the long term, we have had more success sticking to higher quality businesses outside the hyper-cyclical natural resource space.

Outside of North America, the Focus International Equity Fund continues to be positioned to take advantage of the historically low (and therefore attractive) valuations for international stocks. The discount of international markets to North American markets has been 15 years in the making, and we believe even a mild reversal of this trend portends many years of potentially attractive returns.

The first quarter was a challenging one vis-à-vis benchmarks, however we believe in the companies we own and their ability to generate attractive returns over the next three to five years. This stands in stark contrast to “the market”, which has been driven more by narrative than fundamentals and which could struggle to match its recent performance. Our fundamental approach and discipline has generated attractive returns over the past 4 years, with both strategies significantly outperforming their benchmarks during that timeframe.

Public Fixed Income

Fixed income markets were once again challenging during the quarter, although the two Focus bonds funds added positive absolute and relative returns during the period.

Ever since the US Federal Reserve meeting last November, investors have struggled to attempt to predict the future path of interest rates. Entering 2024, Canadian bond investors appear to have been pricing in numerous interest rate cuts during the year. However, with economic data proving once again resilient and central banks reiterating their commitment to fight inflation, investors had to adjust to a scenario of (only) three interest rate cuts, as opposed to five or six. That adjustment had a negative effect on the bond market during the first quarter, with the RBC Broad Bond Index falling -1.2% and long-term government bonds falling -3%.

The Focus Fixed Income Fund managed to generate a positive return by employing a barbell approach – benefitting from attractive “carry” on short term corporate bonds while having meaningful duration exposure to longer term government bonds. The latter would serve to diversify portfolios in the event of a recession as government bonds tend to appreciate during economic weakness and market volatility.

High yield bonds performed well during the quarter, with the High Yield Bond Index (HYG) gaining 1.5%. The Focus Credit Opportunities Fund benefitted from this dynamic and registered a gain of 4.1% during the period. The high yield market continues to offer attractive, and in some cases, equity-like rates of return. When these types of bonds are purchased with short maturities, this results in the potential for excellent “risk-adjusted” returns.

Alternative Investment Strategies

Focus alternative investments are conservatively managed “tools in the toolbox” which we include to serve as portfolios ballasts—a way to steady returns in challenging investment environments. As a reminder, they include asset classes other than traditional stocks and bonds, and in the case of infrastructure and real estate, are not traded on public exchanges. While these strategies have less liquidity (and therefore volatility) than listed securities, the inability of most investors to gain access to these areas can result in attractive returns.

Within the alternatives, the private funds report with a three-month lag, a common feature of the alternative world. As such, at March 31st, we are able to report the full year results ending December 31st, 2023.

Focus Infrastructure & Real Asset LP

This fund invests in assets that have value because they are often essential to the daily functioning of the economy, such as renewable power, transportation, logistics, communications and data infrastructure, and energy storage.

2023 results were ahead of the long-term target of 10% for two reasons. First, our partners pursuing the mid-market infrastructure space and the student housing sector continue to generate strong results as the cash flows of the underlying projects have been unaffected by the volatile business environment and have offset higher interest rates. Second, in early 2023, we made an opportunistic purchase of an existing infrastructure LP interest in the secondary market at a meaningful discount. In other words, we used the lack of liquidity in private markets to our advantage.

Focus Private Debt LP

Private debt refers to loans negotiated directly with companies or individuals, real estate lending, working capital loans and trade finance. We focus on shorter term, floating-rate debt with significant security in terms of claims on underlying assets or cash flow.

The sector continues to benefit from some of the highest yields in over a decade, with borrowers adapting well to macroeconomic challenges. Amid moderating inflation and sustained strength in the labour market, private debt continues to deliver compelling risk-adjusted returns. Yields on new senior loans are pricing at 12%+. Default rates on mid-market issuers remain significantly below previous periods of economic stress, such as 2008/2009.

“We made an opportunistic purchase of an existing infrastructure LP interest in the secondary market at a meaningful discount. In other words, we used the lack of liquidity in private markets to our advantage.”

Parting thoughts / Look ahead

In times when hype dominates market mood, it’s important to anchor oneself onto a sensible and disciplined investment approach. Compelling investment opportunities rarely exist where everyone else is already looking. While companies exposed to the AI trend show real growth potential, the price paid for this growth also matters. Put differently, a BMW 4 series is a great car but it’s not worth a million dollars.

Ultimately, the current environment reinforces the argument for a truly diversified portfolio. Having a diversified portfolio means not having to worry about one part of your portfolio underperforming or outperforming a specific area.