The following is an excerpt from the quarterly newsletter distributed to clients.

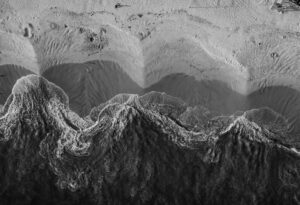

Steady as the tide goes out

The global economy withstood pressures again this quarter. Despite ongoing monetary policy tightening by central banks and recessionary fears, growth remained resilient (albeit slower). Policy makers continue efforts to bring inflation under control, a journey that is neither over nor likely to finish without further fallout. Against this backdrop, major equity indices around the world rallied.

Focus portfolios chartered a steady course through this environment. While it was difficult to match the quarterly rally in mega-cap (i.e., very large) technology stocks in the US, Focus equity portfolios made headway, fixed income funds avoided losses in the bond market and our alternative strategies methodically added value – in one case by a fair amount.

When a system is squeezed, pressure starts to expose weak points. Rising interest rates have revealed multiple vulnerabilities in the macroeconomic environment. Private and public debt levels are elevated, particularly in Canada. Projects that were once supported by cheap rates and increasing asset valuations—for example, in the commercial real estate market—appear hazardous. Investors saw signs of these vulnerabilities in the banking crisis that engulfed the US financial system earlier this year and forced a coordinated policy response.

More signs of stress are likely to come. Even with improving supply chain conditions, easing commodity prices and receding price levels, inflation remains too high. Central banks have signaled their commitment to lowering it further, which should keep pressure on financial and economic systems for some time. The tide is still going out. The longer it does, the more likely are credit losses and/or a recession.

Investors should prepare for both volatility and opportunity ahead, while remembering that investment returns do not necessarily move in lockstep with economic data. Current conditions present attractive long-term opportunities in both equities and bonds, as well as in public and private markets. However, a discerning eye and disciplined security selection is paramount: there are good and bad apples in this barrel. What’s more, the possibility of eventual inclement weather (a recession) underscores the importance of having exposure to assets that can generate wealth regardless of the economic or investment environment. At Focus, this remains our ongoing mission—investing in sound securities with attractive risk-return profiles, while building portfolios that can offer our clients genuine diversification.

Outlook: Tides, risks and opportunities

In addition to monetary policy, the other dominant investment trend so far this year has been technology. Since Chat GPT first launched in November 2022 and garnered hundreds of millions of users in its first months of operation, the collective consciousness has awoken to the staggering advances in technology that have been made in Artificial Intelligence (AI) in recent years. As The Economist has noted, there has been an entrepreneurial explosion in Large Language Models (LLM) “that makes the dotcom boom look sedate.” Time, capital and exuberance have flown into what increasingly looks like an AI revolution. We are still very early innings into this structural theme, though. Which companies emerge victorious remains to be seen.

Not surprisingly, investors have responded to this trend with unbridled enthusiasm. Since the start of the year, a handful of mega-cap technology stocks have torn through indices on an upward trajectory: according to a recent memo from Sanford Bernstein, tech stocks are up +38.0% in the first half of 2023, outperforming the rest of the market by +32.6%. The NASDAQ 100 Index has just registered its best opening six months ever. And at +54.0% premium to market, technology stocks are now valued at twice the average premium—the highest in 45 years.

For perspective, this rally from AI-fever is also a “snap back”. Recall that 2022 was also the second worst year on record for the NASDAQ. Last year large cap technology stocks were summarily pummeled.

Within this environment and notwithstanding our tempered views on the broader stock market indices—now dominated by the expensive-looking mega-cap technology stocks—we still find plenty of opportunities in public equities. In particular, valuations appear attractive in one of the Focus “sweet spots”—mid-sized North American companies. Numerous high-quality companies that we have wanted to own for some time have finally become attractive from a valuation perspective. These investments should do well over the next 3-5 years.

The investment outlook has also improved materially outside of equities. Frankly, two years ago was a dismal period for bonds. Now, government bonds once again provide a competitive yield. Corporate bonds also look more attractive than they have in some time. In fact, current conditions look more and more like what one might call a “credit picker’s market.” While some companies with over-stretched balance sheets and poor capital allocation will invariably default, the debt of borrowers with healthy balance sheets and good cash flow positions may offer attractive returns.

And there are other pockets of opportunity for discerning investors, too. One prime example is the Canadian real estate market. Obviously, higher interest rates add pressure to highly levered real estate business models. For example, the Canadian commercial office space is being challenged by monetary conditions—and may continue to be so. But office towers are only one component of the greater real estate market, which, in Canada, is otherwise reasonably healthy. For instance, while rates rise, there is also a lack of housing in major cities and a national immigration policy that is translating into demand for hundreds of thousands of additional multi-residential units. Like with public equities and fixed income, investors who can differentiate may find room to add value.

Finally, in addition to options in public markets are those in alternative asset classes. To date, Focus private funds have contributed strong returns while muting client portfolio volatility. We continue to see attractive areas in which to deploy capital in these asset classes. While less liquid, many alternative investments offer returns less correlated with the interest rate or economic environment and add truer diversification to client portfolios.

Final thoughts

Volatile though the environment may be, Focus strategies continue to navigate a steady course throughout these times. Our team finds both compelling and weak investment opportunities in both private and public markets, and in both bonds and equities. Meanwhile, our alternative asset classes continue to play the role they were created to do: diversify client portfolios.

As a final note for the quarter, please see the attached wealth planning and advice thought-piece regarding vacation properties. The title speaks volumes: “Vacation Home Conundrums”.