The following is an excerpt from the quarterly newsletter distributed to clients.

Looking Back, Moving Forward

March 2023 marked an important anniversary for investors. We are now three years from the COVID-lows in financial markets, when a novel virus erupted onto the world stage, causing a global pandemic and shutting down the global economy. It is remarkable to reflect on how far we have come since then: to remember those early moments of confusion, and uncertainty, when shuttered industrial production and remote work caused eerily clear skies, households collectively hoarded toilet paper, and no one really knew what to make out of reports from China, Italy and elsewhere. The world then was a bad dream.

But while the economic world has since returned to a (relative) state of normalcy, investment conditions are dramatically different today than in March 2020. Economies might be open, but the interest rate environment has shifted. Persistently higher inflation in many developed countries has pushed central banks to aggressively raise interest rates. What was once a giant tidal wave lifting all boats—a golden era of more than three decades of low or declining interest rates—is over.

Investors have felt the transition keenly. 2022 was an especially difficult period, with interest rates rising and both equities and bonds suffering. That said, Focus clients generally fared better than most within this period: over the last year ending March 31st, when Canada’s S&P/TSX declined 5.2% and the RBC Broad Bond Index was down 1.6%, the Focus Core Equity Fund delivered a return of +9.1% while the Focus Fixed Income Fund generated a return +3.0%. Meanwhile, the Focus Fund (formerly the FAM Balanced Fund) delivered a +7.6% return against a benchmark return of -2.1%. Over the past three years, the Focus Fund has significantly outpaced its peer group of Canadian balanced funds (+15.4% annualized return versus +5.3% for the benchmark)

These results protected and grew client wealth even in a difficult environment, and were a by-product of our team executing our investment philosophy which includes:

- Investing in sound individual securities through a diligent long-term, bottom-up process

- Seeking opportunities for real diversification in balanced portfolios– including through some alternative asset investments with compelling risk-return profiles and less or no interest rate correlation

Looking out over 2023, much of the world has changed, but then, much also remains the same. Most of the trends that are currently playing out, while unique, are not necessarily novel over the long history of financial markets. Likewise, while some of the newer strategies being implemented at Focus are innovative, they are based on timeless investment principles. As ever, our goal at Focus is deep work and independent thinking that builds wealth for clients over generations.

Quarter in Review

The following is a brief recap of the Focus investment strategies for the first quarter of 2023. Note: For the Focus alternative strategies, comments reflect the fourth quarter and full year of 2022 as these funds have a three-month lag in reporting. Returns are expressed in Canadian dollars and before fees due to our sliding fee schedule.

Equities

Performance was strong during the quarter for both Focus equity strategies. The Focus Core Equity Fund delivered a return of +7.7% while the Focus Dividend Equity Fund rose +12.1%. This compares to the S&P 500 return of +7.1% (in Canadian dollar terms) and the S&P/TSX return of +4.6%.

Over the last three months, US equity markets were primarily driven by a reversal of fortunes in a small group of large, “mega-cap” technology stocks. This group was beaten down by markets throughout 2022 and has since rallied. That said, although the Focus Core Equity Fund has increased exposure to the technology sector over the last two quarters, it’s worth noting that our team is finding the most exciting long-term opportunities outside of the technology sector – in other businesses and business models which generate attractive streams of cash flow and offer promising long-term growth.

Meanwhile, the Focus Dividend Equity Fund is positioned to benefit from a reversal of the long period of underperformance by high-quality, international dividend stocks relative to their US counterparts. This reversal is now two quarters in the making and has plenty of potential runway.

Fixed Income

The bond market staged a recovery during the first quarter, after experiencing one of the worst fixed income “bear markets” in history. The two Focus fixed income funds managed to keep pace with the broader bond market recovery despite having much less interest rate exposure. This steady performance is rendered more remarkable in light of how significantly these funds outperformed in 2022: both finished in relatively flat territory (actually protecting capital) when bonds generally declined between 10 and 15%.

Given the tenuous inflation environment, a nimble approach will be required in fixed income moving forward. Central banks are managing inflation but have not—as was once ascribed to late Fed chairman Paul Volcker’s actions—“broken its back.” So, while central bankers may have paused on more rate hikes, any worrisome inflation data could quickly reverse that stance.

The conservative Focus Fixed Income Fund rose +3.0% during the quarter and currently yields approximately +5% (with a duration of 2.1 years). The higher return-seeking Focus Credit Opportunities Fund rose +1.6% during the period and has a yield to maturity of over 10% (with a duration of 2.9 years).

“While the economic world has since returned to a (relative) state of normalcy, investment conditions are dramatically different today than in March 2020.”

Balanced Strategy

The Focus Fund (formerly the Focus Balanced Fund) outpaced its peer group of Canadian balanced funds during the quarter and gained +4.0%. We are pleased with the performance considering the average Canadian balanced fund declined over 9% in 2022 and was due for some form of a “snap-back” recovery. (Recall the Focus Fund managed a positive return of +2.2% last year). The fund has exposure to all but one of the Focus investment strategies—Infrastructure and Real Assets—which will be added shortly. As such, it is relatively unique in terms of the breadth of diversification across asset classes and inclusion of conservatively managed alternative strategies.

Alternative Investment

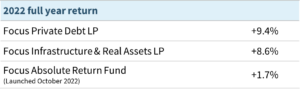

2022 was an excellent test case for the resiliency of the Focus alternative strategies. All three funds posted positive returns in a year where most publicly-traded asset classes fell by double-digits.

We view alternative investments as important “tools in the toolbox” that add essential diversification to client portfolios. Managed conservatively, alternative investments can serve as portfolio ballasts—a way to steady returns in challenging investment environments.

The alternative funds report with a three-month lag, which is a common feature of the alternative world. As such, at March 31st, we are able to report the full year results ending December 31st, 2022.

Considering the tough investment environment in 2022, both private funds had excellent years. Within the Focus Private Debt LP, the floating rate nature of the underlying loans has resulted in substantially higher “base rates”. Furthermore, “spread widening” has resulted in new loans being priced with yields that are more than 4% higher than one year ago. On top of higher yields, lenders are structuring deals with lower leverage levels and tighter credit protections. In one of our recent discussions, one partner commented that this is “the best market for our type of investing since the global financial crisis.”

Within the Focus Infrastructure and Real Assets LP, underlying investments continue to perform well. A recent development to note (subsequent to quarter end), was the purchase of a Limited Partnership interest of an existing infrastructure fund. By purchasing the interest in the secondary market, we were able to acquire it at a substantial discount to the net asset value. Not many firms have the capabilities to participate in the secondary market and we are excited about future opportunities to deploy capital in a similar way

Outlook on The Economy and Markets

At the best of times, the economy is a complex adaptive system that is difficult to predict. At present time, we are witnessing a recovery from an event not experienced in over 100 years (a global pandemic) occurring in tandem with the end of a thirty-year plus run of low or lowering interest rates that made cheap capital and financing available to nearly every level of society. Central banks now walk the unenviable tightrope of fighting inflation without suffocating growth.

Perhaps it’s no surprise, then, that this economic situation continues to confound the experts. High-profile skeptics have been predicting a recession for almost two years, contrary evidence notwithstanding (some may even recall the heated debate nine months ago in US media regarding an alleged government conspiracy to change the definition of recession in order to bury the truth). Yet the North American economy has continued to surprise on the upside. Meanwhile, markets appear to price in some form of economic downturn: many stocks fell 30-50% during the turmoil of 2022 and have not yet recovered. Some high-quality corporate bonds also have yields in the high-single digits. And as noted, many advanced economy yield curves remain inverted. Clearly, investors are requiring more compensation for taking on risk.

Recessions happen. One is always coming—this is the nature of economics—we just don’t know exactly when. In the present moment, and on the one hand, there are plenty of signs that the odds of a recession in the next 3-12 months have increased, including observable cracks in the banking and financial system, deteriorating consumer and corporate debt positions from higher rates and inverted yield curves. On the other hand, advanced economies including Canada, the US and Europe have exhibited remarkable resilience. Inflation readings have gradually been falling, even with still-tight labour markets. The pace of policy tightening has slowed. In short, advanced economies show signs of both fragility and strength.

In market conditions like these it is essential to remember that near-term volatility, while tenuous and challenging, is different from long-term wealth generation, and macroeconomic factors, while important, are not synonymous with investment success. Moments like now offer opportunities to set up both offense and defense down the road. This is what our team continues to focus on now: finding opportunities to invest in quality businesses at better valuations, while constantly seeking for ways to make client portfolios resilient to the various risks in the investment landscape.

Annual Investor Meeting SAVE-THE-DATE

We are looking forward to connecting in person this year during our annual meeting on May 10th, 2023. A formal invitation outlining all event details will be sent out in the coming weeks.