Our succinct perspective on key investment and wealth-related issues.

Japan was set to be taken. Sailing from the mainland were some nine hundred ships and one hundred thousand men under the command of Kublai Khan, grandson of legendary conqueror, Genghis Khan. The seasoned military commander had marshalled a force powerful enough to overwhelm the island’s defenses. The only problem? Wind.

As the Mongol fleet lay waiting to come onshore, a giant and early season typhoon struck, sinking nearly half the ships. Even more wild? A few years earlier, Khan had tried to invade Japan, and his ships were destroyed in a terrible storm then, too. The 1274 and 1281 tempests were so fortuitous the Japanese called them ‘divine winds’ (and named them kamikaze).

Japan was saved, twice, not from their own skill, but from fortunate ocean conditions.

Over the course of history there have been notable events like this, when a few lucky souls were saved by good conditions. Investors know these stories well: in investing, both skill and luck can deliver desirable outcomes. Markets also feature long-term trends that play out like protracted tidal waves (one always hopes to be astute, or lucky, enough to ride one). But good luck can breed its own problems when it is misattributed; when the sailor attributes smooth sailing to his own skill, and not the giant wave he rides, and learns the wrong lesson. That gets dangerous.

In the world of investing, the “60-40” portfolio is a universal term. If you follow the financial media, you know that 2022 was an historic year for the 60-40 portfolio, as investors following this philosophy watched their portfolios post double-digit declines. But a new year has arrived, which has caused pundits to ask whether it is time to “double down” on this beleaguered approach.

We would submit that the 60-40 has rarely ever been what we were told it was. Moreover, the conditions ahead are likely to be very different from those in the 60-40’s golden era. Far too many Canadian investors and advisors cling to this approach despite its obvious limitations.

It’s time we upgrade this vessel.

The Old 60-40

Let’s start with a quick review of the traditional 60-40 portfolio. The structure is named for its mix of assets: 60% in public equities and 40% in bonds (typically a mix of government bonds and investment-grade corporate debt).

The foundational premise of the 60-40 portfolio is simple: direct a little more than half of the portfolio to growth (offense) and a little less than half to stability (defense). Have enough equities to deliver attractive absolute returns and beat inflation. Have enough bonds to temper the volatility of equities and provide downside cushion in falling equity markets. When equities go down, bonds will rally. And vice versa. Frankly… it’s not a bad idea and would be a reasonable approach for many investors, were only theory practice.

How have balanced portfolios like this fared over the last forty years? Very well. For four decades, the 60-40 portfolio appeared to be a fool-proof solution – delivering reliable high-single-digit returns with lower volatility.

The problem with reading too much into these glowing results, though, is the long wave that has been operating underneath them. Over the last 40 years, interest rates declined spectacularly, from 15%+ in the early 1980s to near zero during the height of COVID stimulus. Meanwhile, global growth was juiced by the dramatic expansion of credit across all levels of society – consumer, business, and government – in both the developed and developing world. These conditions set the stage for great absolute performance in almost every publicly traded asset class.

Just how attractive are we talking? Equities returned more than 10% annually, as discount rates fell, and price-earnings multiples expanded from averages of 10x in the early ‘80s to averages of 20x or above. Bonds also did exceptionally well, delivering much higher coupon yields plus the unanticipated bonus of capital appreciation. Even over centuries of available public investment data these are attractive numbers. Market conditions were generally good.

Against this backdrop, the 60-40 portfolio seemed almost genius. Investing was great! Easy! But was this structure everything we were told it was? No, it was not. Because a foundational principle of the 60-40 is diversification (offense and defense), and much of the theorized diversification was illusory.

In universities and financial theory, students are taught that public equity and bond returns are uncorrelated. In the real world, they are often not. That’s because both are sensitive to the overall interest rate environment.

When rates fall during periods of economic uncertainty, stocks and bonds do exhibit a negative correlation (i.e. stocks go down, bonds go up and my portfolio is “diversified”). But during rising, or even stable, interest rate regimes, the two asset classes historically show a positive correlation (i.e. sayonara “diversification”). Investors were rudely reminded of this fact in 2022.

In other words, over the last forty years, investors in 60-40 vehicles happened to land on an excellent outcome, the way the Japanese happened to benefit from a typhoon (twice). Divine intervention in both cases, perhaps, but very doubtfully wisdom or skill.

Market Conditions

Investors today face a much different environment than the one that launched the golden era for the 60-40 balanced portfolio. Interest rates today are more like 4% and not 15%. Inflation is running in the mid-to-high single digits and central banks continue to signal their intention to tame it. In equities, earnings multiples are already expanded, and corporate earnings face an uphill battle. These are not numbers that necessarily herald exciting returns.

At the same time, bonds and equities remain highly correlated.

If we run some (overly simplified but still instructive) math, what might we guess are base case expectations for the traditional 60-40 portfolio?

- Valuations in public equities are still elevated, so we believe investors should reconcile themselves to a long-term return that tracks earnings growth. With margins at all-time highs and cost pressures looming, prepare for 5-7% returns in this asset class.

- Absent the tailwind of capital gains from failing rates, government and corporate bonds should be expected to mechanically earn their yield-to-maturity. That means a return target of roughly 4% in today’s environment.

These numbers imply something like a 4-6% expected pre-tax, pre-fee (and pre-inflation!) return expectation for a 60-40 portfolio. Meanwhile, elevated correlations between stocks and bonds suggest a less diversified and more volatile ride is in store.

Obviously, many possible scenarios may unfold, and these are just some figures to ground a discussion. But the math looks very different than it did decades ago – and so should your portfolio.

The New 60-40

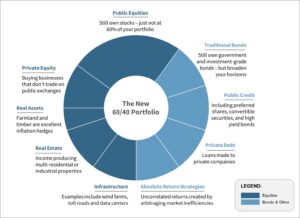

Returning to the original premise of the 60-40 portfolio, we find there is still a sound idea there. A balanced portfolio with equity-like return drivers, bond-like capital preservation and real diversification remains a reasonable ambition. But how do we achieve it?

At Focus, our team believes one answer is what we call the “New 60-40.” This portfolio embraces the objectives of the old way while incorporating a wider variety of asset classes – including those that provide attractive rates of return with less correlation to the direction of the stock market or interest rates.

While this approach is “new” to many Canadian high-net-worth investors, it has been successfully implemented for decades by the world’s largest and most sophisticated investors (think of the Canada Pension Plan, Yale Endowment, or global family offices).

For instance, here is what the “equity” portfolio of a New 60-40 might look like:

Always Ready to Shift

When the Japanese finally surrendered to Allied forces in 1945, it was a huge deal. No one had ever successfully invaded Japan in two thousand years. The closest anyone had come were the two Mongol forces led by Kublai Khan which were repelled in 1274 and 1281 by fervent shore defense and two fortuitous typhoons. That Japan was divinely protected had become etched into the collective consciousness. They could not fathom defeat until it was undeniable.

Though the collective fathoming of an entire nation is clearly a deeper matter than the question at hand here, some of the psychological similarities are worth noting. It’s human to stick with what has worked for you in the past. That does not always make it wise.

Especially when you won from luck.

Investors should continue to question the traditional deployment of the 60-40 strategy and look for new ways to upgrade it.