Our succinct perspective on key investment and wealth-related issues.

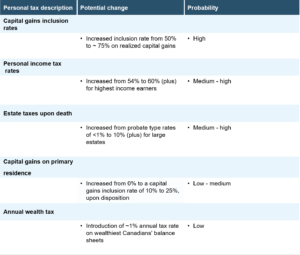

In a recent interview with Focus Asset Management, Jeff Spinks from Koster Spinks and Koster highlighted five areas where increased personal taxes are likely under consideration by the federal government in response to our nation’s growing debt levels. As Canada’s fiscal stimulus soared with the introduction of the Covid-19 Emergency Response Act and as government coffers experience significant revenue shortfalls due to a weaker economy, our country’s annual deficit is estimated to approach $350 billion this year, up significantly from only $35 billion last year. This record deficit spending, as per the graph below, is driving our accumulated net debt at the federal level towards an all time high $1.2 trillion, representing 50% of GDP compared to 35% last year.

Based on these staggering figures, Jeff Spinks suggests that increased personal taxes are on their way to impacting most Canadians, especially those with meaningful net worth. At Focus, we are actively engaging our clients to identify relevant and efficient strategies that address these variables for each investor’s unique circumstances.

For a full copy of the interview with Jeff Spinks, where we discuss what the changing tax landscape might look like and how to best navigate the relevant variables, please send us a note at info@focusasset.ca