Our succinct perspective on key investment and wealth-related issues.

Immigration – more important than you think

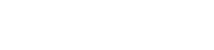

Most investors know that Canada’s real estate sector has been one of the hottest in the world and is a big contributor to Canada’s economic growth. However, the magnitude of that contribution may surprise many.

In fact, residential real estate investment represents 9.4% of GDP, as of the third quarter of 2020. This is not only the highest rate seen in at least 60 years (see chart below), it is also high by international standards. For context, during the peak of the housing bubble in 2006, US residential investment equaled 6.7% of GDP. The current rate in the US is just 4.3%.

Most pundits cite low interest rates and Canadians’ willingness to take on higher debt loads as the main drivers of the real estate sector. However, one key factor that is often overlooked is the impact of immigration. Although the subject of immigration becomes topical during election cycles, from an investment perspective it garners surprisingly little attention.

Few people realize how important immigration is to Canada’s economic growth and specifically how much it has boosted the Canadian housing market. We highlight this topic as recent immigration trends have now turned negative for the first time in years. Should this trend continue, the negative impact to the Canadian economy could be material.

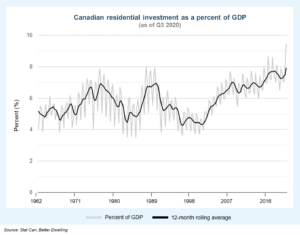

For many years, Canada’s population growth has been amongst the fastest in the OECD. In 2019, Canada’s population grew at a rate not seen in three decades (see chart below). In absolute terms, the 530,000-person increase in the population of Canada during 2019 was more than that of France and England combined despite having a fraction of the total population. And more than 80% of Canada’s increase in 2019 was due to net migration. But Canada’s population growth hit a wall in 2020 as immigration ground to a halt due to COVID-related factors.

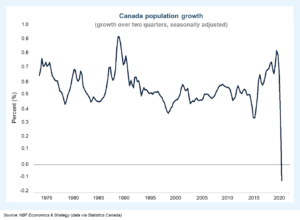

The growth of immigration (specifically 25-44 age segment) is crucial for household formation and explains differences in housing price appreciation amongst countries since 2008 (see chart below). Countries that experienced a 7% or higher increase in this age demographic over the last 12 years experienced home price increases of greater than 60%.

What will the future of immigration look like? The Federal government certainly does not intend to slow the pace of immigration. It has raised targets from 300,000 in 2017 to 350,000 in 2021. Recent figures from January confirm that immigration has indeed started to recover. Going forward, Statistics Canada projects that the most important 25 to 44-year-old segment will grow 6.9% annually over the next 10 years, which would continue to exert positive influences on the Canadian housing market.

But trends in immigration should be watched closely by investors, given its outsized importance to the growth of the Canadian economy. Canada’s economic breadth has narrowed due to the decline in the manufacturing and energy sectors. Our country was fortunate that real estate picked up the economic slack in other sectors; however, the narrow breath increases risks to the Canadian economy should the real estate sector disappoint.

If immigration growth fails to return to pre-COVID rates, the domestic economy could face headwinds. And in turn, we believe investors would be confronted with challenges in the following areas:

- Interest rates: could stay at generational lows due to a weak Canadian economy – positive for some stocks, negative for financials

- Banks: a significant portion of the banks’ revenue growth is from new accounts opened by new Canadians – negative for banks

- Consumer discretionary sectors: weak demand for autos, appliances, entertainment, etc. – negative for these sectors

- Real estate: housing prices could stagnate or fall on a sustained basis for the first time in years – negative for lenders and consumer discretionary spending