The following is an excerpt from the quarterly newsletter distributed to clients.

During the second quarter, global markets staged a powerful rebound from the COVID-19 induced declines experienced in March. As a reminder, the 35% market declines from their highs earlier this year were as quick and violent as anything seen since the 1930s. Although not as historic as the selloff that occurred in the first quarter, the rally in markets in the second quarter was still impressive. The S&P500 rose 20%, its best quarterly showing since 1998. In Canada, the TSX rose 16%, its best quarter since 2009.

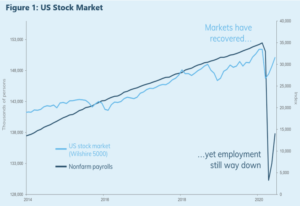

It is entirely reasonable to ask: Why have markets been able to rally so much when unemployment is second only to the Great Depression and the global economy is only now emerging from a government-imposed shutdown?

In our last quarterly letter (and in a video we distributed in May) we described the efforts by governments and central banks to support both the global economy and financial markets in the face of the mandated shutdown put in place to crush the spread of COVID-19.

To recap, governments greatly expanded fiscal measures (essentially paying millions of people to stay home from work) while central banks such as the US Federal Reserve conducted extensive monetary easing (flooding the financial system with liquidity). Stimulus such as this was not used at the onset of the Great Depression and our outlook would be different in the absence of this significant support. To date, these efforts have proven successful in averting an economic calamity, and the battle against the virus has shown significant progress in much of the world.

Although some markets have recovered more than others, it is impressive how much stocks in general have recovered a significant portion of their losses from earlier this year despite the economic weakness that is clearly visible to most people, as can be seen on the accompanying chart which juxtaposes unprecedented unemployment with a relatively buoyant stock market.

This has created the perception of a “disconnect” in people’s minds between what markets are reflecting and the economic situation on the ground.

In other words, have markets moved too far, too fast? Looking at the chart, it is tempting to infer that markets are in a state of denial with respect to the very real risks that COVID-19 poses to the economy. Might markets sell off if we encounter a “second wave”? What if the virus results in a change in consumer spending patterns that permanently alters the economy? Is the market being too complacent?

At first glance, it would seem the market is pricing in a decent economic recovery. However, the situation is perhaps more nuanced. Although the S&P500 is down only a modest amount from its high in early February, the average stock within the index is still down considerably. In fact, 80% of US stocks are down, and the average loss is almost 22% year-to-date. On the flipside, the 20% of stocks that are positive in 2020 have an average gain of 12%. This is a massive bifurcation within the market.

Unlike previous market recoveries which have seen broad-based participation from the economically sensitive parts of the market as the economy expanded, the recent market recovery has had a decidedly “defensive” tone to it. The best performers have been the perceived winners in the shift to “work from home” in the face of COVID-19. Foremost amongst this group is the technology sector, which has enabled the work transition. However, recent market darlings also include companies like Netflix and the exercise bike upstart Peleton, which have filled the gap with respect to people’s downtime when sheltering at home. Many pundits are declaring these shifts as permanent, justifying premium valuation multiples for these companies. When combined with the incredible amount of money injected into markets by the central banks, it has created a supercharged environment for growth and momentum stocks. Not since the bubble days of late 1999/early 2000 have we seen valuations and stock price moves of this magnitude.

To illustrate this phenomenon, we contrast the performance of two stocks (neither of which we own) to show how the market has pushed some stocks to record new highs while continuing to ignore others. Software giant Microsoft and the leading US bank JP Morgan are both considered excellent businesses and their stock prices have historically moved in the same general direction albeit at different rates depending on the environment. As one can see, Microsoft stock has clearly benefitted from the COVID-19 environment, rising over 30% year-to-date while JP Morgan stock is off by over one-third. In terms of valuations, Microsoft is at a 15-year high while JP Morgan is close to the lows witnessed at the depths of the Global Financial Crisis in 2009.

Traditionally, when stock markets begin to anticipate an economic recovery, the move would include banks such as JP Morgan. And this situation is not confined to the banking sector alone. Numerous companies and industries that would be expected to participate in an economic recovery-led stock market rally have not done so. Clearly, the market does not seem to be pricing in a “v-shaped recovery” in any traditional sense.

The implication is that a large portion of the stock market strength since the recovery continues to be powered by large, momentum-driven growth stocks that have benefitted from the COVID-19 fallout. Apparently, investors have not yet placed big bets on an across-the-board economic recovery. Therefore, when we hear that “the market is ahead of itself” or “market strength is disconnected from reality”, we respectfully point out the massive bifurcation within markets at the current time. While some parts of the market look “bubbly” to us (and therefore unattractive) other parts of the market seem much more reasonable.

This apparent lack of faith amongst market participants in an economic recovery is good news for patient investors, as we do expect the global economy to slowly heal itself in the coming 12-18 months. High-quality companies that have reasonable valuations should continue their recovery over this period. Conversely, as the economy normalizes, parts of the market that have benefitted from the “work from home” trade could disappoint given high valuations and expectations.

In Canada, this phenomenon is best exemplified by one stock – Shopify. We discussed the truly shocking valuation of what is now Canada’s largest company in the video we sent out in May. To recap, Shopify trades at 77 times trailing revenue! By comparison, Amazon currently trades at a mere 5 times revenue. As if navigating these challenging markets wasn’t difficult enough, Shopify was responsible for over one-third of the 16% rise in the S&P/TSX during the quarter.

Company Spotlights

ATS Automation

ATS Automation is a Canadian company that should benefit from the repatriation of manufacturing back from China to North America in the wake of COVID-19 and recent trade friction between the US and China.

ATS is a global leader in automated/robotic manufacturing and assembly systems in four key segments:

- healthcare (55% of revenue) – medical devices and pharmaceuticals

- transportation (25%) – electric vehicles (EVs), automotive and aerospace

- energy (10-15%) – nuclear and solar energy

- consumer products (10-15%) – cosmetics, electronics, food & beverage

ATS delivers solutions to customers that lower production costs, accelerate product delivery, and improve quality control, on both greenfield programs (equipping new factories) and brownfield programs (capacity expansions and factory optimization). ATS is compelling for the following reasons:

Attractive end markets with strong secular demand growth. ATS has intensified its focus on the healthcare, electric vehicle and food segments – industries with attractive growth profiles and large barriers to entry (highly regulated, complex manufacturing).

Potential for “onshoring” of manufacturing. For two decades, major corporations moved manufacturing capacity to markets with low labour costs to improve profitability. Rising trade tensions and the COVID-19 pandemic have exposed vulnerabilities of the global supply chain, particularly when it comes to sectors with critical inputs such as life sciences and pharmaceuticals. Companies are actively searching for ways to “repatriate” elements of their supply chain. The only way to do that economically is through increased use of automation/robotics. As a real-world case study, ATS helped one of its medical device customers move the manufacturing of a key product from China to North America. The customer now has greater confidence in its ability to meet North American demand, and because they were able to reduce manual labour by 90%, gross margins on the product actually improved from 45% to 60% as a result of the transition.

Strong balance sheet provides significant financial flexibility. ATS entered the COVID pandemic with a strong balance sheet and ample liquidity to deal with current economic weakness. Net debt/EBITDA is well below 2x and the economic dislocations caused by the COVID pandemic should greatly improve the M&A opportunity set. Strong organic growth, augmented by continued bolt-on acquisitions, combined with a substantial margin-expansion opportunity create the potential for a long runway of double-digit earnings growth and improving returns on capital

TELUS Corp

Most Canadians know of TELUS as one of the country’s major telecom providers. TELUS is a well-run business with a solid balance sheet, steady income generation and an attractive and growing dividend. Those characteristics alone would be worthy of an investment but upon further inspection we believe there is even greater value.

Buried within TELUS are two businesses that have substantial unrecognized value. First, TELUS International, which provides business process outsourcing solutions to third-party customers across numerous industries. These services include artificial intelligence solutions, social media and content support, the provision of multi-channel contact centers and help-desk functions, back-office support, risk management and administrative finance and accounting functions. In May 2016, TELUS sold a 35% stake to Baring Private Equity Asia at a valuation implying significant value creation.

The second hidden business within TELUS is more dynamic. TELUS Health provides virtual care that effectively triages patients based on their unique circumstances so that in-person visits occur only when virtual services cannot meet patients’ needs. Virtual patient/physician interactions help reduce the number of in-office encounters, decrease the length of visits, and allow for more patient-centric care. Industry experts predict that at least half of all health care services will eventually be provided virtually, giving TELUS Health large tailwinds. By some estimates, TELUS Health is already the largest medical technology company in Canada and on a standalone basis would command a premium valuation.

When the solid, core TELUS telecommunication franchise is combined with the potential of these two undervalued businesses, we believe TELUS shares present a very attractive risk/reward proposition for investors at the current time.

Closing Comments

Negative headlines with respect to COVID-19 and the economy are everywhere. We, like you no doubt, see plenty of reasons to be cautious. And yet, we won’t dwell on them here because it is equally important to keep in mind that markets are forward-looking and there are also offsetting reasons to be more optimistic. Here are several:

With respect to COVID-19:

- Every day that passes brings us closer to a vaccine which could make a huge difference, especially to sentiment. The entire global medical research community is focused on this effort.

- Even barring a scientific breakthrough on the vaccine front, there are reasons for optimism with respect to therapeutics.

With respect to the market:

- As we touched on earlier in this letter, although it appears that the market is pricing in meaningful economic recovery, upon closer inspection it is apparent that large parts of the market are still trading at depressed levels. As governments around the world ease lockdown measures, economic activity is resuming and companies are adapting quickly to the situation.

- According to Fidelity Investments, the nation’s largest stock brokerage, almost one-third of their clients over the age of 65 liquidated their entire stock portfolios during the market downturn. Unfortunately, this sort of behavior tends to occur at market bottoms, and if history is any guide, a good portion of those funds will likely be slowly invested back into the market at higher levels.

- Despite the rally in markets, when we look at various stock market sentiment indicators, we are still seeing a fair amount of negative sentiment (which we view as a positive). Only in the technology/growth/momentum areas does it seem that sentiment is signaling frothiness.

With respect to the economy:

- We should not underestimate the amount of stimulus that has been injected into the global economy and markets by governments and central banks in response to the economic downturn. In the US alone, the Federal Government and the US Federal Reserve have injected somewhere between $6 and $8 Trillion into the economy. That is approximately one-third of the country’s GDP, an incredible amount. When combined with the fact that interest rates are close to zero, this stimulus is like rocket fuel which has and could continue to provide a positive catalyst for the economy and stocks for the foreseeable future.

In closing, there is plenty of uncertainty in the short term with respect to both the economy and the virus. However, on balance we expect the global economy to continue to recover and the negative COVID-related news in the US to improve in the coming months.

Still, given the unprecedented nature of the current situation and the uncertainty with respect to potential outcomes, we believe it is best to have a fairly cautious but constructive stance at the present time. As such, we have high cash and liquidity levels to be able to respond to opportunities if they present themselves. We are prepared for volatility, but it is not a foregone conclusion. Longer term, we believe decent returns can be achieved by following a disciplined investment philosophy and sticking to a plan which includes a diversified asset mix.