The following is an excerpt from the quarterly newsletter distributed to clients.

Covid – one year later

Although the COVID-19 crisis continues to exact its horrible toll around the world, from the perspective of markets at least, COVID has been in the rearview mirror for over a year now. That statement may surprise many people; however, that is their nature. Despite extremely challenging circumstances, markets can be surprisingly unemotional and forward-looking.

Given the current state of asset markets, it is easy to forget the situation that prevailed this time last year. Exactly one year ago, global stock markets reacted to the COVID crisis by crashing over 35% in one month, the quickest decline of that magnitude on record. Since then, stock markets have recovered and have recently posted new highs as governments and central banks around the world essentially did whatever it took to keep the global economy from collapsing and set it on a path to recovery.

However, as we have communicated to clients, the stock market recovery has come in two very distinct phases. Phase one was powered by technology companies that allowed society to keep functioning and working from home. The second phase of the market recovery was fueled by the economic recovery, which really began in earnest during the summer of 2020. Phase two has been led by economically sensitive stocks and commodity sectors that will benefit from a return to normal for the global economy.

Unfortunately, the first phase of the recovery was not overly friendly to value-conscious investors as expensive growth stocks simply became even more expensive. However, the second phase has been very rewarding for value investors but much less so for the growth and momentum crowd. This recovery dynamic has continued into 2021, resulting in strong performance for our strategies during the first quarter, which we will address later in the letter.

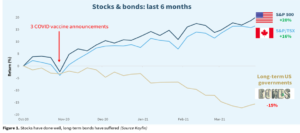

The economic recovery was further turbocharged last November by multiple COVID vaccine announcements. Since then, economic recovery is now a question of when, not if. Stock markets have surged and as usual, have received all the attention. However, the global bond market has also been affected by the improving economic outlook because it has caused longer-term interest rates to rise – (and as rates rise, bond prices fall). As illustrated in Figure 1 below, the gains in stock markets have been almost diametrically opposed to the losses in longer term government bonds. In fact, the selloff in government bonds has been one of the worst in decades.

One year ago, during the turmoil surrounding COVID, interest rates went to record lows causing the prices of long-term government bonds to appreciate significantly. Since last summer, as the prospects for economic recovery began to improve, these perceived “safe havens” have suffered as investors have pivoted towards buying assets, such as economically sensitive stocks, that stand to benefit from a recovery. To date, the transition from super-safe bonds has been orderly, and has followed the playbook of previous recoveries.

Inflation: the new worry?

Yet market participants are always worried about something. Last spring and early summer, the worry was that the pandemic and associated lockdowns would cause the global economy to slip into a depression. With economic growth recovering quickly, that risk seems unlikely. Now, the outlook for very brisk economic growth, coupled with unprecedented fiscal and monetary stimulus, has introduced something new to worry about – ever-rising interest rates and the potential for uncontrolled inflation.

Historically, very high levels of inflation are associated with losses not only in bonds, but stocks as well. The financial press, always looking for the next big story, has begun to warn about the spectre of runaway inflation. Although we believe it is too early to proclaim that a new era of 1970s-style secular inflation is upon us, it is something that bears monitoring. In the near term, it is likely that strong economic growth in the quarters ahead leads to moderately higher interest rates and inflation. This, in turn, could result in continued weakness in government bonds as well as other beneficiaries of low rates (such as highly valued growth and momentum stocks). As long as interest rates rise in an orderly fashion in parallel with economic growth, reasonably valued stocks with solid fundamentals should continue to provide decent returns.

Private Investment Funds

The investments in the private funds are performing well and continue to meet our expectations. Holders of the funds can expect specific updates shortly.

The goal of the Focus private funds is to offer:

1) enhanced investment returns while,

2) lowering overall portfolio volatility.

Enhanced returns can be achievable because fewer investment dollars are competing for returns in the private world. For example, due to regulatory constraints, traditional banks are no longer as active in lending to mid-sized businesses. The Focus Private Debt Fund seeks to capitalize on that opportunity.

Reduced volatility can be achieved because private investments are not listed on public exchanges, greatly reducing the emotional swings that characterize publicly traded investments.

Infrastructure will prove to be an important theme moving forward if we are to believe the initiatives being planned by governments around the world. There is clearly a need to upgrade roads, bridges and power infrastructure in the years ahead. Additionally, one of the ways that governments will likely pay for the COVID support efforts over the past year is by selling infrastructure assets to the private sector. The Focus Private Infrastructure and Real Assets Fund is a direct way to participate in this secular growth area. We look forward to speaking with clients about the opportunity to invest in these areas.

Company Spotlights

Renewable Energy

Renewable energy and sustainability in general are themes that, for obvious reasons, are becoming near and dear to the hearts of many investors. Unfortunately, that passion for investing in the technologies that will deliver the world a cleaner future can often result in dangerously overvalued investments. But a thoughtful approach is possible. During the quarter, volatility in markets allowed us to add to our existing holdings and initiate new positions in this area.

Brookfield Asset Management (existing)

BAM has significant exposure to renewables through its ownership of Brookfield Renewable Partners, one of the world’s largest publicly traded renewable power platforms. BAM also recently launched a new business under the leadership of former central banker Mark Carney that will focus on helping non-renewable companies (energy, steel, cement, etc.) transition to a net zero world, which it expects to eventually be a $50-$100 billion platform.

NFI Group (existing in Enhanced Equity, new in Core Equity)

Leading manufacturer of zero-emission buses (ZEB) with 45% market share in North America. Municipalities around the world are undergoing a transition to ZEBs, and NFI is positioned to be at the forefront of this movement. The dynamics of buses (short haul, centralized fueling and storage) lend themselves to EV/hydrogen better than passenger vehicles, evidenced by ZEB buses’ 20% share of the global fleet already (expected to double to 40% by 2030).

Boralex (new)

BLX is a pure-play renewable company with a high-quality, well-diversified installed base of wind, solar and hydro assets in Canada, France and the United States. The company has a strong growth pipeline, with installed capacity expected to grow organically by an additional 25% by 2023. Despite a more attractive asset base (markets, counterparties, contract length, etc.), it trades at a discount to its peer group.

Air Products & Chemicals (new)

APD is a leading global industrial gas company with a strong track record of growth and profitability. APD’s expertise and global infrastructure give it a significant competitive advantage in emerging areas of sustainability and de-carbonization. One of the most exciting developments is a $5 billion joint venture in Saudi Arabia for a carbon-free (green) hydrogen facility that will be powered entirely by renewable energy, is expected to produce 650 tons of hydrogen per day and save the world 6 billion pounds of CO2 per year.

TransAlta (existing)

TransAlta trades at a discount to its peer group due to its legacy asset base that had material exposure to coal-fired generation but which will be completely phased out by 2023. TransAlta has significant exposure to renewable energy (over 40% of generation now comes from wind, solar and hydro). Additionally, TransAlta is a leader in the energy transition movement through its investments in additional wind/solar capacity, battery/storage technology, carbon capture, pumped hydro and hydrogen.

Closing Comments

Focus investment strategies are off to an excellent start in 2021. Furthermore, over the past year those same strategies have shown equally solid performance.

With respect to outlook, we expect the global economy will continue to recover, led by the US, which should benefit the earnings of many of our holdings. We also suspect market participants will continue to gain comfort in the economic recovery story. As this occurs, money could continue to flow out of the safe havens that performed so well during the COVID crisis, such as government bonds, mega-cap technology stocks and precious metals and into other areas of the stock market that are more reasonably valued.

Earlier, we talked about the losses recently experienced by government bonds as investors rotated away from their perceived safety. The graph in Figure 2 illustrates the effect this rotation has had on just a fraction of the stock market names that performed so well during the crisis phase of COVID. In a client communication last spring, we mentioned Amazon, Clorox, Domino’s Pizza and Zoom as examples of stocks that had benefitted from COVID. As can be seen, the stocks have significantly underperformed the more “value-oriented” Dow Jones Industrial Average over the last six months. This trend could continue.

On a further encouraging note, recently some of the extreme froth that characterized stock markets has subsided. Despite the strong equity market returns in the first quarter, many growth stocks have corrected meaningfully. For example, Tesla, which we highlighted as being extremely overvalued in last quarter’s letter, suffered a 40% decline from its high in January. Many of the more speculative parts of the market have corrected even more.

On the economic front, we are likely to witness impressive growth numbers in the quarters ahead as GDP surges and unemployment continues to fall. However markets in general are far from their lows of a year ago and generally speaking, valuations for stocks are not cheap from a historical perspective. This keeps us with a fairly balanced, yet still positive outlook – especially for the parts of the market that we view as still undervalued and likely to benefit from the recovery.

Longer term, we are attuned to the potential risks of significantly higher inflation. Although we are not forecasting such a scenario, we have incorporated the possibility into how we manage our various investment strategies.