The following is an excerpt from the quarterly newsletter distributed to clients.

2022: How diversified are you?

Jason Zweig, investment guru and writer of the Wall Street Journal’s “The Intelligent Investor” column, recently wrote about the reality facing many investors so far in 2022 (see Figure 1).

The rest of the article goes on to analyze the mistakes investors often make when their portfolio has suffered a large drawdown. These sorts of columns usually appear every five to ten years although he wrote a similar piece as recently as the spring of 2020 following the collapse of markets during COVID.

Thankfully, Focus clients have not had the same experience – our investment strategies have on balance held in well during this very challenging period. And to be fair, Canadian investors in general fared a little better than their US counterparts – a result of the Canadian market having a high exposure to energy stocks (oil & gas prices spiked following the Russian invasion of Ukraine) and a lower exposure to technology stocks (which have been decimated over the past 12 months).

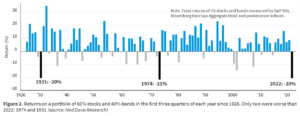

Still, 2022 has been a truly historic year. Although in the past stock markets have fallen more than the 24% drop in the S&P500, it is usually accompanied by a gain in bonds – not the double-digit losses experienced in most bond portfolios this year. The uncomfortable reality of combined stock AND bonds losses has now lasted an unprecedented three consecutive quarters and rivals the two previous worst precedents – 1974 and 1931 (see Figure 2).

Those two years witnessed crushing economic downturns – the former accompanied by inflation, the latter by seemingly endless deflation. Yet today, unemployment is near all-time lows and demand for goods and services continues to be strong. It is therefore no surprise that the average investor is confused by what is going on in the world of finance these days

Closing comments

The major story so far in 2022 has been one of interest rates rising higher and faster than most investors thought probable only one year ago. These increases are a concerted effort by global central banks to tame a spike in inflation that has not been experienced in forty years. The fallout has been one of the worst investment periods on record for traditional “balanced” portfolios, rivalling some of the most painful periods for markets in history.

Central banks seem steadfast in their commitment to lower inflation, and there are signs that they are starting to succeed. However, the more they raise rates, the higher the probability they go too far and cause a recession, perhaps a severe one. Central bankers are therefore walking a tightrope between hiking too much (and causing a recession) and stopping the rate increases too soon (and seeing inflation become entrenched similar to the 1970s).

Although many elements of the inflation story have started to moderate, we do not know where inflation will settle out – i.e., it may come down somewhat but remain uncomfortably high. In the end, the outcome depends on the deliberations of a small group of well-meaning and very intelligent women and men at the US Federal Reserve – who are just as prone to making mistakes as the rest of us.

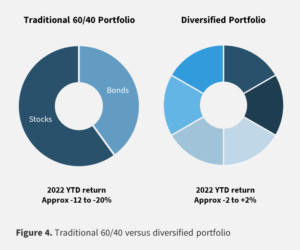

The only comfort in this situation is true diversification. Figure 4 below tells a tale of woe for the traditional 60/40 balanced portfolio so far this year. A robust portfolio, diversified across asset classes and straddling public and private markets has held in exceptionally well in 2022. Regardless of the outcome in the coming months and quarters, we believe the same will continue to hold true.