The following is an excerpt from the quarterly newsletter distributed to clients.

Grin and “Bear” It – Finding Opportunity in a Volatile Market

Global markets resumed their slide during the second quarter of 2022 as consternation over inflation, rising interest rates, and the possibility of a potential recession weighed on investor sentiment. Notably, the S&P 500 registered a 23.6% decline from its former highs, breaching the “down 20%” threshold that signifies a bear market, en route to its worst start to a year since 1970.

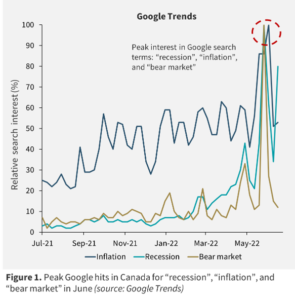

Inflation remained too hot for comfort, with May’s 8.5% year-over-year increase in the U.S. Consumer Price Index reading signaling the highest level of inflation seen since 1981. This prompted another round of interest rate hikes from global central bankers – with the promise of more to come – in an effort to rein in rising prices. The hawkish tone from policymakers, coupled with signs the economy is softening at the margin, gave rise to fears of an impending recession. As Figure 1 suggests, Google searches for “recession”, “inflation” and “bear market” have recently spiked.

The weakness in equities was broad-based, with all market sectors and geographies posting negative returns. Even energy stocks, which had shone during the first quarter of 2022, retrenched due to weakening commodity prices. Moreover, rising interest rates and a general negative tone also roiled fixed income markets. As measured by the RBC Broad Bond Market Index, the average Canadian bond portfolio declined 5.7% during the quarter, bringing the year-to-date return to -12.2% on the supposed “safe” part of many investors’ asset allocation.

Readers of our letters will know that Focus had been girding for a rise in interest rates and at least the possibility of a corrective phase in equity markets for some time. We had been positioning our clients’ capital accordingly – keeping a very low exposure to interest rate risk, assiduously avoiding overvalued sectors and stocks, and diversifying clients’ portfolios to include less volatile asset classes.

Make no mistake: our objective is to produce positive absolute returns, and we do not seek plaudits for being “down less than the market.” However, we note that Focus’ public market strategies have materially outperformed their respective benchmarks while our private market strategies have held steady. In sum, our clients have been insulated from the brunt of a nasty market sell-off. Meanwhile, we are mindful that periods of heightened volatility and fear create opportunity. Our team has been active in capitalizing on this dynamic, acquiring attractive securities at dislocated prices in both equity and fixed income markets. We expect this opportunism to bear fruit for our clients as markets normalize.

The prospect of a bear market sounds as menacing as an 800-pound grizzly. And indeed, the volatility has lured bombastic pundits out of hibernation and elicited sensationalist comparisons to dire episodes in the past, as it always does. However, removing emotion from the equation, a representative historical bear market has resulted in a 25%-30% market drawdown. When looking at the S&P 500 at current levels, we are effectively a stone’s throw away. Moreover, valuations in equity and credit markets have declined swiftly, with pockets of those markets already discounting a fair amount of bad news.

In the end, we concentrate on individual security selection, as opposed to trying to guess what markets will do. That discipline has served us relatively well in 2022 and we are confident it will continue to do so in the future.

Closing Comments

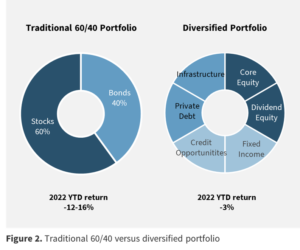

In last quarter’s letter, we suggested the first quarter could be viewed as a “shot across the bow” in terms of what the future could hold for investors if inflation was not brought under control. That message continued during the second quarter. However, there was an additional headwind – the potential for a recession induced by central banks in their efforts to bring inflation under control. Although the market narrative during the quarter shifted from “inflation fears” to “recession fears,” neither was particularly friendly to the average investor with a traditional portfolio. Furthermore, for a balanced portfolio tilted towards growth and technology stocks (for equities) and long-term bonds (for fixed income), it was absolutely disastrous. We showed the following chart (see Figure 2) at our recent annual meeting – the difference in returns year-to-date between a traditional “60/40” portfolio and a more diversified asset mix.

2022 has so far provided a good test case in terms of measuring the robustness of one’s portfolio. We suspect it won’t be the last such challenging period in the years ahead. It is for this reasons that we encourage clients to explore the benefits of a broadly diversified portfolio.

As for the current malaise afflicting stock and bond markets, we don’t spend too much time trying to make predictions. However, we would say that much damage has been sustained by markets and at some point we are likely to get a reprieve given that: inflation is likely to moderate from here and the fundamentals of the US economy look decent by historical standards

We can confidently report that we are seeing plenty of investment opportunities that make sense to us on a three-to-five-year view. Business as usual in other words.