The following is an excerpt from the quarterly newsletter distributed to clients.

Never a straight line

The second quarter was a decent one for investment returns as both stock and bond markets recorded strong gains during the three-month period. Canadian and US stock markets both rose by 8.5% in local currency terms. In fixed income, long-term interest rates fell, allowing broad bond returns to show a quarterly gain for the first time in nine months.

On the economic front, US employment and wage gains have been impressive and the recovery in consumer confidence is starting to accelerate.

After such a strong quarter for markets and the North American economy, one would imagine the tone of market participants to be quite positive. Although that was arguably the case in early April by the time June came to a close, the tone of the market was very different indeed.

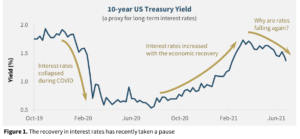

In the space of three months, investors went from worrying about runaway inflation and rising interest rates to a near-unanimous belief that any inflation will only be short-term in nature and that interest rates will be stuck at the current levels for years to come. The following chart (see Figure 1) illustrates the path of the most important interest rate benchmark, the yield on the US 10-year Treasury Bond. As a reminder, interest rates play a large role in the valuation of all asset classes. After collapsing to all-time lows during COVID, interest rates began to rise last summer, commensurate with the recovery in the global economy. When interest rates rise in a slow and steady manner and in conjunction with economic growth, it is perceived as a positive for risk assets such as stocks. It is only sudden and violent spikes in rates that are viewed as a negative. More recently, long-term interest rates have started to weaken again despite the prospects for strong economic growth in the quarters ahead. Could this be a sign that the recovery is in trouble? Or that the Federal Reserve will tighten (raise interest rates) too soon in their efforts to fight inflation and thereby choke off the recovery? That is the current concern. The alternate view is that perhaps rates are simply “taking a breather” after increasing significantly during the last nine months and will resume their upward trajectory soon enough. Time will tell, but it is without a doubt the most important question in financial markets at the current time and a reminder that markets never travel too far in a straight line.

Company Spotlight

Vertex Pharmaceuticals

Vertex Pharmaceuticals is a name that many clients will recognize from the past. Vertex is a global biotech company with a focus on Cystic Fibrosis (CF), where its four approved drugs have a virtual monopoly. In a sector notorious for stratospheric valuations, Vertex looks attractive given its $51 billion enterprise value is supported by $7 billion in revenue, 55-60% margins and $3 billion of free cash flow. Over time, revenue from CF should grow to $10 billion by addressing the untreated segments of the market. Shares of Vertex look well supported by the CF franchise alone. However, Vertex continues to advance a pipeline focused on other diseases such as alpha-1 antitrypsin deficiency (AATD), APOL1-mediated kidney diseases, sickle cell disease, beta thalassemia, Duchenne muscular dystrophy and type 1 diabetes. Despite a history of successful drug development, the market seems to be ascribing little in the way of value for this pipeline of opportunities. Finally, merger and acquisition activity within the biotech sector has picked up dramatically in the past 18 months, and with the shares off 33% from their recent highs, Vertex represents an attractive risk/reward proposition.

Closing Comments

Focus investment strategies continue to perform well in 2021. The investment theme that we have held since the lows of the markets in March 2020 – that the global economy would slowly but surely recover from COVID – continues to play out.

However, a recovery like this has never been experienced before, and the economic data surrounding the recovery can be confusing and uneven, causing crosscurrents within markets. As one example of this contradictory dynamic, one day we hear that employment is recovering too slowly while the next day brings the telltale signs of wage inflation. If the former theme is correct, it would mean growth is weaker than expected and one should own government bonds and other conservative investments. However, if the latter is to be believed, one should be positioned in commodities and economically sensitive stocks and should avoid long-term bonds. Economists are tying themselves in knots trying to understand the current situation, which has virtually no precedent.

When the confusing and uneven nature of the recovery collides with the fast-paced and short-term nature of asset markets, there is bound to be market disruption. In fact, we may be experiencing a bout of volatility at the current time.

However, we did recently see a simple yet insightful description of the current economic environment from a market pundit that may help to explain the confusion in markets these days. It may also provide some comfort to the casual observer.

“We just went through a very difficult 15 months. The vaccine rollouts are happening quickly but are not complete. A lot of people moved, and there is going to be geographical mismatches. Also, out of opportunity or necessity, a lot of people transitioned to other activities or industries. Parents’ childcare situations may not be fully worked out yet. The same applies for people living with people who need care (elderly or disabled). Older participants in the labor force may have decided to accept a buyout or retired to enjoy more time with family. This, in turn, is moving the rest of the workforce up a rung. The economy consists of 200 million people performing hundreds of different activities across dozens of different industries distributed along thousands of geographic places, and we just shook that up for a whole year. It’s going to take some time to re-equilibrate. The jigsaw puzzle is going to take some time to piece together. Some months will be good, some less so. We will make steady progress for a long time and then solve it really quickly once there’s few pieces left. Enjoy the trend. There will be time for worrying later, much later.”

– Conor Sen, Bloomberg

Markets will surely see some volatility along the road to recovery. Corrections are a healthy feature of the investment world. A pause refreshes a bull market. The good news is that we are still finding relatively attractive investments that do not require heroic assumptions about interest rates, inflation, commodity prices or economic growth. And until we can no longer do that, we will move forward with a constructive view.