The following is an excerpt from the quarterly newsletter distributed to clients.

Preparing for Unknown-Unknowns

Thoughtful investors are always attuned to potential risks. Heading into 2022, the attention of market participants and media pundits was trained on the following:

- Would the Omicron wave trigger an economic slowdown?

- Would surging inflation prove to be a transitory consequence of snarled supply chains, or a longer-term problem?

- Would central banks threaten economic growth and asset prices by raising rates aggressively to combat said inflation?

The answers to these questions were uncertain, but the questions were well telegraphed. These were what former U.S. secretary of defense Donald Rumsfeld might call “known-unknowns”.

But as is often the case, the most profound events this year – from an economic, financial market and humanitarian perspective – have emanated from a risk few were paying attention to. The Russian invasion of Ukraine was an “unknown-unknown”.

Most poignantly, this crisis has claimed the lives of untold Ukrainians and displaced millions more. It has also elicited a host of economic sanctions against Russia from the international community, which have vaulted the price of commodities higher and exacerbated inflation concerns.

The “unknown-unknown” of the Ukraine war has conspired with other dynamics to create a volatile environment – and a challenge for many investors in both public market stocks and bonds.

On balance, global equity markets declined by 5.3% for the quarter. In the United States, the S&P 500 experienced a peak-to-trough drop of 13%, while the technology-heavy (and richly valued) Nasdaq Composite suffered a 22% decline from its former highs. While the TSX Index was one of the only markets to post a positive return on the quarter, this result was entirely attributable to the performance of Canadian energy shares – which rocketed in response to spiking commodity prices.

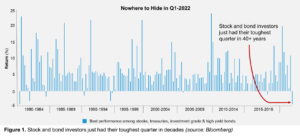

Occasional volatility in stocks is to be expected, but here’s the rub: equities were not the worst performer. The traditionally “safe” part of investors’ portfolios, bonds, posted their worst quarterly return in over four decades. Rising inflation, and consequently rising interest rates, saw the average Canadian bond investor lose 7% in the first three months of 2022 (as interest rates rise, bond prices fall). Combining the negative results in equities with the poor performance of fixed income meant that most investors experienced a quarter they would like to forget. As the accompanying chart illustrates, it was one of the worst quarters for a portfolio of stocks and bonds since 1980 (see Figure 1).

As we will discuss in this letter, Focus’ equity and fixed income strategies held in well during the quarter, preserving our clients’ capital in a challenging environment, while positioning portfolios to take advantage of opportunities that emerged from volatility.

However, we believe this quarter was a warning to investors that the relationship between stocks and bonds they are accustomed to (“when my stocks go down, my bonds will be up”) may not hold in future. This underscores the importance of diversification: adding asset classes to your portfolio (such as differentiated credit, private infrastructure and private debt) to preserve capital, reduce volatility, and produce returns that do not depend on the direction of stocks or bonds. In our opinion, that is how best to position a portfolio for the next “unknown-unknown”.

Closing Comments

In last quarter’s letter, we suggested that:

- higher interest rates could pose a challenge for public markets

- government bonds and technology/growth stocks were particularly vulnerable

- we have structured portfolios with that potential scenario in mind

- our private funds were designed to deliver attractive and consistent returns in such an environment

The first quarter was painful for many market participants. This time, it was bonds that surprised to the downside. However, in the future, it is entirely possible that stocks could experience a setback. Perhaps inflation will turn out to be transitory and the things that have worked well for the last 40 years will continue to do so. On the other hand, perhaps the first quarter should be thought of as “a shot across the bow” and a taste of what could be in store if inflation cannot be brought under control by central banks. The future is as uncertain as ever.

For several years now, Focus has been evolving our approach to offer clients truly diversified and robust portfolios in order to withstand what could be a very different environment in the years ahead. This has included the introduction of several unique investment strategies. We would encourage clients to consider this broader approach. Notwithstanding the volatility in Q1, a well-diversified portfolio held in admirably, and looks poised to deliver attractive results in the years ahead without having to make a “one-way bet” in terms of outcomes.