Our succinct perspective on key investment and wealth-related issues.

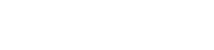

“Unprecedented” is a word we have heard frequently in the last two years. And while we are reluctant to contribute to its overuse, the extraordinary fiscal and monetary stimulus enacted in the wake of COVID-19 pulled global bond yields to low levels that were truly… unprecedented.

Now a year and a half later, and despite the rebound in economic activity, inflation, and equity markets from the March 2020 lows, yields on government bonds remain anchored at extraordinarily low levels – with yields on other fixed income assets pinned down in sympathy.

When investing, there is arguably no prospect of earning a return without assuming risk. But now, for a high-net-worth individual, we would contend that investing in traditional fixed income is effectively assuming risk without the prospect of any return.

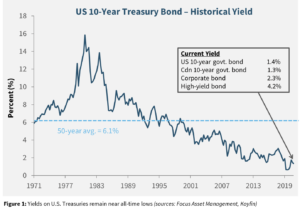

Consider the following: buying a 10-year Government of Canada Bond provides a paltry yield of 1.3% per annum (see Figure 1), while investing in a traditional bond ETF or mutual fund is likely to yield under 2%. These return prospects are dim to begin with, but after factoring in taxes, fees, and any mild inflation, investors in these instruments are all-but assured of eroding the real value of their capital (see Figure 2).

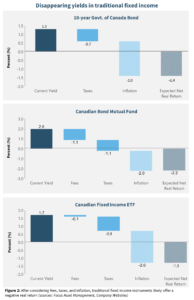

Now consider the risks inherent in these traditional bond investments. The price of a bond moves inversely to its yield: as the yield increases, the bond’s price (or the value of a fixed income ETF or mutual fund) decreases. If interest rates were to increase by even one percent – still staying extremely low by historical standards – investors in these assets would face material declines in the value of their fixed income holdings (see Figure 3).

For decades, as interest rates have fallen, investors have been well served by the 60/40 (60% in equities, 40% in fixed income) rule of thumb in constructing a portfolio. However, with yields at rock bottom, today we believe this model is fundamentally flawed. Most investors are unlikely to be satisfied with their outcome if 40% of their portfolio now offers a negative expected real return – while exposing their capital to the risk of rising rates.

How should you overcome low rates? Start with a thorough analysis of the fixed income instruments you own: understand the types of securities they represent, the return potential they offer (net of fees and taxes), and the types of risk they introduce into your portfolio. Next, assess whether the attributes you are seeking from fixed income (e.g. capital preservation, diversification, or income yield) could be replicated in more attractive asset classes. Many high-net-worth families we speak to discover that their goals can be better met by reducing their exposure to traditional bonds and adding more innovative tools – like credit strategies, private debt, and real assets. To us, these strategies are indispensable in this environment.

These are unconventional times in the bond market. Don’t let your portfolio be hampered by conventional thinking.