Our succinct perspective on key investment and wealth-related issues.

Following a munificent 2021 in markets, investors could be forgiven for feeling a little complacent.

After all, most assets in their portfolios delivered sizable gains last year, propelled by a heady mix of earnings growth, low interest rates, unprecedented central bank stimulus, and a liquidity-fueled appetite for risk in markets.

However, we think it is important to consider that many of these benign conditions have changed with the calendar. With inflation surging, earnings growth dimming, rates rising, and central bankers intending to remove the market’s “punch bowl”, the tailwinds of 2021 may indeed become headwinds in 2022.

So, to start the year, we offer our thoughts on three risks in 2022 (affecting equities, bonds, and portfolio construction, respectively) and three ways you can better prepare your portfolio for the road ahead.

The Risk: Expensive, Concentrated Equity Markets Are Flashing Warning Signs

We are reminded of the adage that, “history may not repeat itself, but it rhymes.” While equity investors may feel sanguine about the recent performance of their stocks, ETFs, or funds of choice, history would suggest that the equity market’s valuation, extreme concentration, and narrow breadth are sending ominous signals.

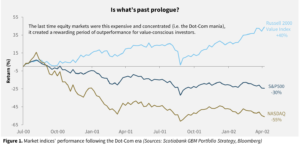

Using the S&P 500 index as an example, the benchmark trades at over 21 times next year’s expected earnings – a 30% valuation premium to its historical average. This level of (over)valuation is rare, having last been observed in the late-1990s Dot-Com mania, and tends to presage poor forward-looking returns.

But digging deeper, the valuation of the S&P 500’s ten largest stocks is even more extravagant. These companies trade at over 33 times expected 2022 earnings (68% higher than the historical average), and the “S&P 10” make up over 31% of the index’s total value. This level of index concentration has, again, not been seen the late 1990’s.

It should therefore come as no surprise that just ten stocks (valued at a staggering $11.8T) provided over 40% of S&P 500’s total return for the last calendar year. When is the last time that market gains were disproportionately provided by such a narrow cohort? You guessed it.

Even if you do not directly own these stocks, index-centric investments are compelled to hold mammoth weightings in this small cadre of (mostly) high-growth, technology names. Doing so was a boon in last year’s low-rate, risk-on environment, but could become a significant risk if we are indeed seeing a regime change – towards higher interest rates, lower liquidity and more rational valuations. The darlings of the market in 2021 could become a drag.

What To Do About It: “Zoom” Out from the Index

How can you protect your portfolio from a revaluation in high-flying stocks and the benchmarks they dominate?

Well, fortunately, with investment flows and analysts’ attention trained on mega-cap growth names and indexed products, there are plenty of attractive companies hiding in plain sight. This includes stocks in traditional value sectors, like Financials and Industrials, as well as mid-capitalization companies outside the purview of large ETFs. Two examples include Element Fleet Management and ATS Automation.

Element is North America’s largest fleet management company. With technology stocks having been in vogue, the market is yet to recognize the impressive turnaround being orchestrated by CEO Jay Forbes, and consequently the stock trades at just 10x our estimate of 2023 free cashflow. The business has tremendous runway for organic growth and margin improvement, which we believe will reward investors through dividend growth and share buybacks.

Even with over $4.5B in market capitalization and $2B in annual revenues, you won’t find ATS Automation in any large-cap index funds. This Ontario-headquartered company is a global leader in factory automation, serving customers in secular growth industries like healthcare, electric vehicles and food safety. Despite being a high-quality company with excellent prospects, ATS trades at a material discount to its global peers. We believe that the stock is poised for significant upside on a positive re-rating, even if the temperature of the overall market cools.

Despite the expensiveness of the broad indices, there are great opportunities for disciplined investors in individual securities. We recommend reducing exposure to what was popular in 2021 (large-cap, high-growth, tech) and tilting your equity portfolio toward stocks which are less followed, reasonably priced, and have idiosyncratic return drivers. If history is a guide, these parts of the market could continue to perform well – even if the broader indices suffer (see Figure 1).

The Risk: Bond Market Blues

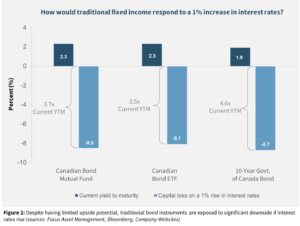

The laggard in most investors’ portfolios in 2021 were the bonds. With their low coupons and heightened interest rate sensitivity, even the modest move higher in rates last year was enough cause a negative return in most bond funds and ETFs.

We don’t believe this story will improve in 2022. With yields still extraordinary low by historical standards, traditional bonds are virtually assured of delivering a negative real return to investors – after inflation, taxes and fees.

And while bond yields are low, bond prices are poised to be increasingly volatile. With inflation at multi-decade highs, global central bankers are now intent on raising rates, while ceasing the bond-buying programs (called “quantitative easing”) that have kept global bond yields low. This should place upward pressure on yields – and downward pressures on bond prices.

Meanwhile, the sensitivity of a representative bond index, ETF or mutual fund to rising interest rates has never been higher. This means that even a slight increase in interest rates can cause a material drop in traditional fixed income assets (see Figure 2).

Translation: expect little (or no) returns from most bond strategies moving forward – but more risk.

What To Do About It: A Tactical Approach to Bonds

For decades, fixed income investing was pretty easy.

As rates fell from the mid-teens to near zero, you could simply buy government bonds (or corporate bonds issued by the monolithic banks, insurance companies and telco’s) and they paid you a handsome income – with the promise of additional capital gains if rates continued to fall.

But now, in an era of low yields and elevated interest rate risk, fixed income investors need a more tactical mindset and a broader arsenal to meet their objectives. We believe this includes high-quality high yield bonds, preferred shares, and convertible debt.

The spectrum of bond credit ratings spans from AAA-rated government securities to CCC-rated speculative paper, with the broad range of debt below BBB referred to as “high yield bonds”. We believe that the highest-quality portion of the high yield corporate bond market (including companies like Ford, Cargojet and StorageVault) offers the best hunting ground for discerning active investors. These bonds pay an attractive income stream, with a shorter maturity profile and lower interest rate risk than government or traditional corporate debt. Within this space, we find quality companies whose balance sheets have improved due to strong earnings, opportune debt refinancing and a plumped equity “cushion” from strong market performance.

Rate-reset preferred shares provide tax-advantaged income and diversification within bond portfolios. The dividends on these securities periodically “reset” based on the current yield of five-year government bonds. Therefore, their dividends and value tend to appreciate as rates rise – the opposite of how most bonds behave.

We believe convertible bonds are also an important element in a modern bond portfolio. On one hand, they have attributes of vanilla bonds, ranking above equity in the capital structure and paying an investor a fixed coupon as well as the par value of their capital at maturity. But these securities also offer the ability to “convert” the bond into equity, at a prescribed price. This means that convertible bondholders receive optionality, with the ability to participate in the company’s future success. Because of their hybrid characteristics, convertible bonds do not fit neatly into the “equity” or “bond” portion of many investor mandates – meaning that the market is less followed and more subject to price dislocations. As a result, an opportunistic investor can often find overlooked convertible bonds that offer attractive value with asymmetric upside potential.

How can you mitigate the risk rising interest rates pose to your bonds, while (actually) getting some “income” from fixed income? Stick to shorter maturity securities, reduce government bond exposure in favour of creditworthy corporates, and broaden your scope to include high-quality high yield, preferred shares, and convertibles.

The Risk: Your “Diversified” Portfolio Might Not Look So Diversified Anymore

The psychologist Abraham Maslow famously said, “to a man with a hammer, everything looks like a nail.”

The “law of the instrument” refers to human beings’ propensity to over-rely on familiar tools, even when they are clearly inappropriate for the new problems we face.

For the last three decades, investors have only had to use one instrument to build a diversified portfolio: the proverbial hammer of the “60% equity, 40% fixed income” portfolio. Against a backdrop of falling interest rates, the tool was very useful to solve investors’ problems. Equities acted as the driver of growth, while bonds provided meaningful income and safety. Because yields were in secular decline, the two asset classes also exhibited an inverse correlation: if your stocks went through a rough patch, the value of your bond holdings appreciated – cushioning the performance of your overall portfolio.

Over that period, the problems that investors faced were, in fact, all nails.

But the capital market conditions we face today bear little resemblance to the environment 30 years ago. And in economic regimes featuring elevated inflation and increasing interest rates (sound familiar?), stocks and bonds tend to become much more correlated, meaning that if your stocks were to go down… well, your bonds might be down too.

Taken together, low (and potentially rising) rates, elevated equity valuations, and increasing stock-and-bond correlation mean that investors following the 60/40 model should be prepared to accept lower returns, with more volatility, from their portfolio.

Or they need to find ways to add new tools to their investing toolkit.

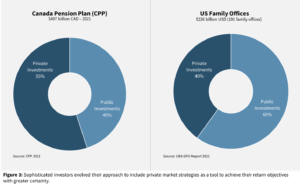

What To Do About It: Follow Smart Money

While most high-net-worth Canadians’ portfolios are stuck in “60/40” mode, astute institutional investors (like the CPPIB or Ontario Teachers Pension Plan) have recognized that an evolved approach is required to achieve their objectives. And outside of Canada, the ultra-wealthy have also acknowledged that the makeup of their portfolios needs to change (see Figure 3).

Sophisticated and wealthy investors have broadened their toolkit to include significant allocations to private market investments. Asset classes such as infrastructure, direct real estate, farmland, and private debt are generally less liquid and less accessible to the masses, meaning that they offer superior return potential to their public market counterparts.

Moreover, while public-market securities are appraised moment-to-moment based on what the marginal buyer in the market will pay, private market assets are appraised according to their long-term cash-flow generation and intrinsic value. This makes them uncorrelated to short-term market gyrations, and an important diversifier against equity and interest rate risk.

Are you unsure if your portfolio is prepared for the challenges ahead? We believe that thoughtfully integrating “best in class” private market strategies is a cornerstone of future success. Let us show you how you can apply the thinking of the world’s largest and most sophisticated investors to reach your goals with greater certainty.