The following is an excerpt from the quarterly newsletter distributed to clients.

2022: A year to remember, and for some, to forget

It may come as a surprise to some (especially those who don’t follow the financial markets), but 2022 will go down in history as one of the worst years on record for most investors. It may also come as a surprise to Focus clients, as their portfolios did not suffer the losses experienced by others.

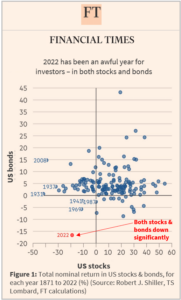

While returns for global stocks were the worst of any year since 2008, it was the additional carnage in global bond markets – the supposed “safe” portion of portfolios – that came as a shock. Indeed, bond markets had their worst year on record. Historically, when stocks are weak, bonds provided positive returns, giving the “balance” to a balanced portfolio. Such was not the case in 2022, as rising interest rates caused stocks and bonds to fall in tandem, causing over $30 trillion of wealth to be erased from public capital markets.

As Figure 1 illustrates, 2022 was an outlier in terms of return characteristics for a traditional 60/40 portfolio (60% stocks, 40% bonds). Few times in history have stocks and bonds suffered losses in the same year (see bottom left quadrant). Furthermore, the magnitude of the combined portfolio loss is among the worst in history. Investors simply haven’t experienced a year like 2022 in recent memory where stocks and bonds where both down dramatically.

The anomalous and confounding nature of 2022 has resulted in predictions of “new regimes” and “paradigm shifts” in the investment world. In other words, “time to do something different”. Although we try to keep an open mind, we believe that avoiding losses in 2022 can be attributed to a relatively straightforward view that interest rates stood a good probability of rising, causing pain across public markets. As such, starting 18 months ago, we:

1.sought to avoid losses in bonds by limiting bond duration, and stayed away from the most expensive and vulnerable equities such as growth and technology stocks;

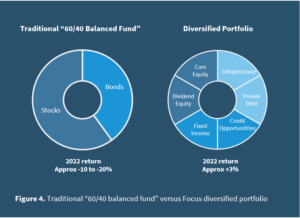

2.continued to advocate for clients to diversify their portfolios to include investments that are better insulated from higher interest rates and inflation than traditional investments (ie. alternative strategies).

These two actions helped to protect portfolios in 2022. As we peer into 2023, some of these concerns now seem less dire. Unlike 12-18 months ago, higher interest rates results in fixed income investors now being well compensated to hold certain types of bonds. Meanwhile, after declines of 40-50%, some high-quality technology stock valuations have become reasonable. As for point #2, however, the lingering question of inflation continues to argue for a truly diversified portfolio in the years ahead.

Closing Comments

2022 was a painful year for the vast majority of market participants. Average portfolio losses ranged from 10-15% in Canada and 15-20% in the US. Unfortunately, many fared far worse. If a portfolio was tilted towards growth and technology stocks, 2022 was eclipsed only by the year 2000 dot com bust and the awful bear market of 1974. However, if an investor happened to be heavily weighted towards traditional bonds, including millions of people in, or nearing retirement, 2022 was literally the worst year on record.

Fortunately, Focus navigated 2022 well. For the full year, and despite the carnage in public markets, portfolios ranged from flat to up meaningfully, depending on the choice of investment strategy and level of diversification.

As for what the future holds, the financial press is filled with prognostications (recessions, inflation, bear markets, bull markets). Our experience is that little, if any, of that content is of value to long-term investors.

Our job is not to predict the future, as it is unknowable. Our job is to be prepared for whatever the future may hold, and to ensure your wealth is protected under different scenarios. On that front, we admit that the current range of possible outcomes may be wider than usual. As such, we continue to believe the same robust portfolio that protected capital in 2022 stands the best chance of helping clients reach their investment goals in the years ahead.

We thank you for your support.