The following is an excerpt from the quarterly newsletter distributed to clients.

Q2 2024 – The Return of Exuberance

The global economy once again remained resilient this quarter. After several years managing dislocations caused by the COVID-19 pandemic and the commodity price shock from the war in Ukraine, policymakers have largely restored price stability. Inflation rates, while still higher than target (notably in the U.S.), are now within striking distance of the 2% level to which central banks aim. Meanwhile, corporate earnings are growing, the banking system appears stable, and central banks in a number of advanced economies – including the Bank of Canada and the European Central Bank – have started cutting benchmark rates. These are excellent results.

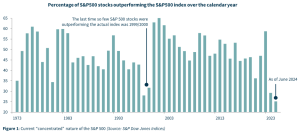

The mood among investors has now unmistakably shifted. Only six months ago this letter encouraged investors to look beyond what was then a dour disposition. Today, buoyed by positive economic news, expectations of further monetary easing and massive capital inflows into artificial intelligence (AI) related companies, investors are becoming, dare we say, exuberant. Year to date, the S&P 500 is up over 15% – though this headline number hardly tells the full story. Underneath this figure is even stronger performance by a small number of mega-capitalization (mega-cap) technology stocks, led by semiconductor maker, Nvidia – which has accounted for a remarkable 34%+ of total S&P 500 returns in 2024. Figure 1 illustrates the current “concentrated” nature of the S&P 500, whereby a handful of stocks are responsible for most of the index returns. In other words, froth is back. It’s not everywhere, but it certainly exists in pockets of public equity markets. At almost 30x earnings, the S&P 500 now trades at valuations close to 2000 tech bubble levels. Many technology and “quality” companies trade far higher.

This shift in both mood and equity valuations makes it important for investors to remember two historical observations. First, while self-reinforcing mania often lasts longer than one might expect or desire, eventually, when expectations untether long and far enough from reality, the cord does break. This is normal, investment gravity. Investors wake up from the dream and enthusiasm is invariably replaced by disillusionment.

Second, the higher expectations are, the harder it is to meet them. For example, a company can grow cash flows and earnings impressively but still have a stock that languishes in the market if expectations were too high to start with. There is a reason no one pays one million dollars for a BMW 7 series, even though it is a great car. Valuations still need to stay somewhat bound to reality. When they don’t is when asset prices languish, or more severe dislocations happen.

Case in point: Costco

One example of the “quality at any price” theme is Costco. The company is a food and consumer goods retailer affectionately known for its cheap, bulk sizes. People who like Costco love Costco: 90%+ of the members in the company’s annual membership program renew. Well-run, with a unique consumer value proposition and business model, strong competitive positioning and international expansion opportunities, there is much to like about the company.

The problem is that everyone already knows this. In recent months the company has garnered significant investor interest and media attention. Trading at over 55 times earnings, robust growth appears priced into the stock price. This means that, while the company could keep executing admirably, higher hurdles will need to be cleared for stock performance going forward to equal the impressive gains of the past. Not to say this can’t or won’t happen — the company has a good formula and is well-run, after all – it’s just much less likely.

This investment principle is relevant to today’s environment. When expectations are higher, there is less room for error. That is the case now for a number of technology and “quality” mega cap stocks. Many of these companies have attractive underlying fundamentals and are exposed to strong growth themes, but trade at valuations that leave practically zero buffer. For the same reason it is harder to win the 100m dash at the Olympics than the local racetrack, when valuation levels are already extremely high, much more has to go right to outperform. That weakens the odds for investors.

Investment Strategies

In May of this year, we held our Markets & Wealth meeting where we provided a detailed discussion, and insights into the current positioning and outlook for our investment strategies. Please reach out to us if you would like to watch the replay of this video.

The following is a brief review of the of the focus investment strategies including highlights from the second quarter as well as the first half of 2024.

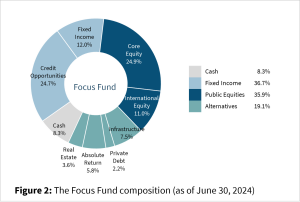

Diversified

We continue to advocate for a diversified approach to asset mix for our clients. Stock markets have experienced significant appreciation over the last 3-4 years and some areas of the market are particularly expensive. As such, we would not be surprised if many stocks were confronted with headwinds. Although we believe a differentiated and disciplined approach to stock-picking increases the odds of success, we also believe that diversification across asset classes will pay off in the years ahead. The Focus Fund is positioned with less equity exposure than its peer group and currently offers clients a robust asset mix:

Public Equities

The S&P500 rose 4.3% in Q2 and 15.3% year-to-date (19.1% in Canadian dollars). While impressive, the narrow participation of the move has been unprecedented: five mega cap stocks represented 60% of the gain year-to-date while three stocks (Nvidia, Apple and Microsoft) accounted for 90% of the gain during the second quarter. In contrast, the average stock, as measured by the S&P500 Equal Weight Index, has risen only 4% year-to-date.

Although we believe the strength in mega cap stocks to be unsustainable, they have definitely been firing on all cylinders. However, the fuel for any fire needs to come from somewhere. That somewhere is small and medium sized stocks. For some time now, investor fund flows have been a one-way street: from small and mid-sized companies into the mega caps, with little regard for valuation.

Counterintuitively, this is a good thing for patient, long term investors. It has left large swaths of the stock market undervalued, with attractive prospective returns. A similar dynamic occurred in late 1999/early 2000. Back then, after a strong run of performance by large technology stocks, small and mid-sized companies went on a multi-year period of significant outperformance relative to the former market darlings, which languished for the better part of a decade.

The Focus Core Equity Fund, which primarily invests in North American companies, is comprised of numerous of such attractively valued growth companies. As an example, during the quarter, funeral home operator Park Lawn Inc was acquired by a private equity firm at a 65% premium to its trading price. We strongly suspect it won’t be the last of our portfolio companies to be discovered by a private market buyer.

“We believe diversification across asset classes will pay off in the years ahead – Focus Fund offers clients a robust asset mix”

From a global perspective, the US stock market now represents 65% of the global market capitalization, a level not seen in many decades, when the rest of the world was far less industrialized. The irresistible pull of US mega cap stocks has had a similar effect on international stocks, leaving them also out of favour, unloved and attractively valued. The Focus international Equity Fund, which invests outside of North America, continues to benefit from these less demanding valuations.

Public Fixed Income

After an unprecedented three consecutive years of annual losses from 2021 to 2023, bond markets are off an additional -0.4% so far in 2024 as measured by the RBC broad Bond Index.

Although a fourth consecutive year of losses is conceivable, we believe that interest rates have likely peaked and that the worst of the bear market in bonds has passed. We believe the Canadian economy will face severe challenges if the Bank of Canada does not continue lowering interest rates. These actions would benefit longer-duration government bonds. These types of bonds offer decent yields in the order of 5% and, perhaps more importantly, diversification properties to portfolios. In other words, in the event of an economic downturn, these bonds should appreciate if risk assets, such as stocks, come under pressure.

The Focus Credit Opportunities Fund invests in various forms of corporate credit such as high yield bonds, preferred shares and convertible bonds. We still see plenty of attractive yield opportunities in short-duration, high yield bonds of companies.

Alternative Strategies

The Focus alternative investment strategies continue to perform as planned, with the main benefit to portfolios being consistent & attractive returns with low correlation to publicly traded stocks and bonds. As a reminder, these funds report with a lag of between one to three months.

- After a strong calendar 2023 the Focus Infrastructure and Real Assets LP got off to a good start in the first quarter ending March 31, 2024. Although not completely immune to interest rate increases, Infrastructure assets have been some of the most resilient investments globally during the recent interest rate spike.

- The Focus Private Debt LP, which is expected to deliver fairly consistent returns in the 7-9% range by lending to private operating companies and real estate projects, performed in line with expectations in the first quarter.

- The Focus Absolute Return Fund is on track for the 6-8% uncorrelated returns expected by employing liquid market strategies such as merger and convertible arbitrage in equity and debt markets.

- The Focus Private Real Estate LP printed its first NAV update, registering a small gain in the first quarter despite being modestly invested. We believe income-producing real estate is a good addition to client portfolios, and the recent rise in interest rates has created numerous opportunities in the sector. These include Canadian multi-residential real estate and student housing.

Looking ahead

One year ago, recessionary fears were rampant. The soft landing in which we now find ourselves was by no means secured. That we now find ourselves in present conditions is great, pleasantly surprising, and a reminder why it is so essential to invest according to a philosophy that does not depend on precise economic outcomes. At Focus, our aim is to build portfolios that advance client goals despite performance in the economy and the broader stock market.

Regarding public equities, it’s worth remembering that this is not the first time in history when we’ve seen extreme concentrations or valuations. At the peak of the Japanese real estate bubble, in 1989, for example, the notional value of all publicly traded Japanese equities accounted for 44% of all publicly traded equities worldwide. Land was valued at $139,000 per square foot, 350x the price of comparable space in Manhattan. On paper, the land underneath the Imperial Palace in Tokyo was worth more than the land under the entire state of California. None of which lasted, of course. The Japanese bubble burst in 1991, real estate values collapsed, and the country entered into what is known as its lost decade. Investment gravity won in the end.

Though different and not yet as extreme as 1989 Japan, there are pockets of hype and market concentration in the U.S. that recall this period as well as the late 1990’s internet bubble. The lesson to take from history is to not get caught up in the hype.

Looking forward, now is a good time to be a patient, long-term investor. Large swaths of the stock market remain undervalued, with attractive prospective returns, pockets of hype notwithstanding. Attractive risk-adjusted returns are also available in other asset classes for investors willing to take a more modern approach to portfolio diversification.