The following is an excerpt from our quarterly newsletter distributed to clients.

Strong Markets, Encouraging Shifts

The third quarter was a strong one for most asset markets, with stock markets in the US leading the way. The S&P500 rose 8.5% (6% in C$ terms) while in Canada, the TSX rose 4%. The quarter was characterized by a very strong July and August for companies that have benefitted from COVID, namely technology stocks. Yet a violent, tech-led selloff in September suggests that market participants are beginning to wonder if the recent growth trends for these richly-valued companies can be maintained.

Importantly, under the surface we saw a definite rotation towards stocks that fit our current investment theme of a slow but eventual healing of the global economy. This was evidenced by our Core Equity strategy outperforming its blended US/Canada benchmark during the quarter despite the impressive strength in the technology sector.

2020 Continues to Confound

So far, 2020 has been one for the history books and we are only three-quarters of the way through the year. Persistent uncertainty has led to understandable feelings of unease regarding the current environment. This unease has permeated markets as well and can be gauged. Stock market sentiment measures continue to suggest that, aside from a few sectors such as technology, investors remain quite cautious.

Perhaps the only good news is that historically, the best investment returns come during periods of heightened unease and volatility.

Recent discussions we have had with clients generally revolve around the following areas:

- How can the stock market look past the currently weak economic situation?

- Will the “second waves” of COVID derail the burgeoning recovery?

- Are we worried about the election?

The Economy

With respect to the economic situation, we look to the US as a guidepost. Unbeknownst to many, the US economy has surprised most experts with its recovery since the spring. The unemployment rate in the US fell to 7.9% in September, down by half from the peak of the shutdown.

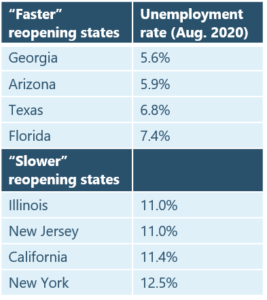

Despite the many political and social challenges, the dynamism and flexibility of the US economy continues to impress. Interestingly, the economic recovery is being led by the US states that either did not lock down as much or re-opened earlier than those that experienced more extensive shutdowns (see table).

Covid Second Waves

Parts of the world are currently experiencing the anticipated “second waves” of COVID, although it is debatable whether these are true second waves or merely first waves in parts of countries that previously had not been affected.

Regardless, it is likely that these second waves will prove much less severe in terms of fatalities than those experienced in March/April. Additionally, news on the vaccine front continues. Despite the vaccine process unfortunately becoming embroiled in the

politically charged environment in the US, vaccinations for the most at-risk may begin within the next three to four months. Because the stock market is both forward looking and unemotional, it may be ignoring the second waves while anticipating a slowly improving economy in 2021 and beyond as the world comes to terms with COVID.

The US Election

It is perhaps more important than ever to separate investing from politics. In short, we do not have a strong view as to which US presidential candidate is more “stock market friendly.” Earlier this year we heard market pundits concerned about the effects a Joe Biden presidency would have on the market, given his platform of higher taxes and more business regulation. Those concerns seem to have subsided recently. Perhaps the stock market-related negatives will be offset by less chaotic policy making on the international trade front. While there could be market volatility in the event that no clear winner emerges, the fact that the US has three distinct branches of government likely ensures that any uncertainty should be minor and short lived.

There are still risks and uncertainties associated with COVID and its effects on the global economy. However, in our opinion the worst case/disaster scenario has been taken off the table due to the efforts of central bank monetary and government fiscal policy. While the road ahead could be bumpy, we believe things will get better, not worse, over the next few years.

Company Spotlights

CVS

We own CVS Health in both the Core Equity and Enhanced Income strategies. CVS is a $75 billion healthcare company delivering affordable, accessible and seamless quality care with three primary business lines:

- Pharmacy Services (46% of revenue): CVS is the #1 Pharmacy Benefit Manager in the US, helping minimize drug costs for 100 million people.

- Retail Pharmacy (29% of revenue): CVS is the #1 pharmacy chain in the US (70% of Americans live within three miles of a CVS), and is dominant in delivering pharmacy solutions to long-term care facilities.

- Health Care Benefits (25% of revenue): Through Aetna, CVS has over 18 million commercial medical insurance members, 2.2 million individual and group Medicare members and 2 million Medicaid members.

Benefits of scale: CVS is one of few companies with the business diversity, technology and financial resources capable of delivering omni-channel health – an end-to-end solution that meets the needs of customers in the community, in their homes and in their hands (digital/tele-health). CVS was early to recognize the changing landscape and has a significant lead over competitors.

Positive secular trends: An aging population, increased incidence of chronic disease, personalized medicine, greater focus on health and wellness and other secular trends are all large tailwinds.

Leader in technology: Advanced analytics, machine learning and artificial intelligence require significant financial resources, technical capability and access to big data. CVS has all of these and is well positioned to benefit.

Significant opportunity tied to COVID: CVS is integral to the pandemic solution in testing, clinical trials, supporting nursing homes with testing capabilities and adapting to consumers’ changing needs (drive-through, at-home delivery). CVS will be a key player in delivery of a COVID vaccine.

Compelling valuation: CVS has a dominant market position in a sector with positive long-term fundamentals, a 15% return on equity, a 12% free cash flow yield, and a 3.5% dividend yield while trading and trades at less than 8 times earnings.

Closing Comments

Given the uncertainty surrounding the second waves of COVID and the upcoming US presidential election, markets could be entering a period of heightened volatility over the next few months. Though volatility is by no means assured, it is important for clients to at least be prepared for this possibility.

However, we would view any such volatility as a potential opportunity for the following reasons.

Markets seem to have come to terms with COVID

COVID caused panic in markets earlier this year because it was a novel coronavirus and markets abhor uncertainty. The current second waves of COVID are extremely distressing for people, but markets are unemotional and now have a much better sense of the potential risks and outcomes. COVID is less able to surprise markets because it has shifted from being an “unknown unknown” to being a “known unknown.”

The US presidential election may be a wild affair, but it too will pass

The political and social institutions of the US have withstood much more challenging periods in the past and survived. Setting personal political views aside, neither candidate looks to pose a material threat to the longer-term health of the US economy, which already weathered the first term of a Trump presidency and two terms of a Biden vice-presidency.

Fiscal and monetary policy is still very stimulative

Policymakers around the world are providing unprecedented amounts of support for their economies and markets. Although there could be a hiccup in the US surrounding the election, further accommodation is likely once the election is out of the way. To date, this support has performed admirably, and could continue to bolster asset prices once COVID finally recedes in earnest.

In summary, although there seems to be an abundance of challenges and potential risks at the current time, we expect the recovery to continue, and therefore, we are continuing with our cautiously optimistic investment outlook. Our stocks will benefit from an improvement in the economy. At the same time, we have plenty of liquidity to take advantage of any air pockets that could materialize.