The following is an excerpt from the quarterly newsletter distributed to clients.

Where opportunity lies

Conflicting investment themes caused volatility for global asset markets during the third quarter. Yet despite the choppiness, returns were relatively flat for stocks and bonds. The S&P500 eked out a 0.6% gain while in Canada, the S&P/TSX was up a mere 0.2%. In fixed income, the RBC Bond Index declined by 0.5%.

In last quarter’s newsletter, we explained that despite decent market returns during the second quarter, the tone of global markets had become quite negative by the end of June. This uneasy market tone continued during much of the third quarter and was caused by concern over several factors:

- rising COVID cases globally

- anticipated Federal Reserve tapering

- supply chain disruption

- US debt ceiling deadline

- rising inflation

- Real estate crisis in China

During July and August, concerns around these issues resulted in a continued shift away from economically sensitive stocks and towards government bonds and growth stocks. During September, these latter areas finally succumbed and sold off as well when interest rates and inflation expectations began to rise. The selloff in growth and technology stocks took the NASDAQ down by over 5% in September alone.

The areas of concern noted above are still present, and therefore could continue to cause bouts of volatility. Politics in the US is a particular wild card while the outlook for inflation is an important topic that could fill an entire newsletter. However, other factors that had contributed to volatility may be starting to recede. While the real estate crisis in China (Evergrande) is serious, it may not actually become “China’s Lehman Brothers moment”. As for COVID, the Delta variant wave has started to ebb. According to former head of the FDA, Scott Gottlieb, the Delta surge may be the final COVID wave in the US.

Given the significant move upwards in markets over the past 18 months, volatility should be expected at some point. However, we suspect the bulk of these aforementioned concerns are shorter term in nature and will resolve themselves gradually. However, one question we often get from clients that deserves a comment is: “Are markets overvalued?”

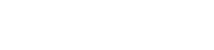

On the face of it, the answer is clearly yes. Broadly speaking, markets do look overvalued. However, we continue to find attractive investment opportunities. To explain why this is possible, the following chart (Figure 1) illustrates the divergence in valuations within the S&P500.

The light blue line represents the valuation (using price to earnings or “P/E” multiples) of the most expensive stocks in the S&P500 while the dark blue line tracks the valuation of the S&P500’s cheapest stocks. As can be seen, the current “spread” between expensive stocks and cheap stocks is as extreme as the technology bubble years of 1999 and 2000.

It may be instructive to remember what occurred in the quarters following the last time we saw such a large spread between expensive and cheap stocks.

Figure 2 above illustrates how investors fared following the large valuation divergence in the year 2000. Over the next 18 months, the S&P500 dropped by 30% and was driven by a 55% decline in the technology-heavy NASDAQ. By contrast, the Russell 2000 Value index (a proxy for less expensive stocks) rose almost 40% during the same period. Clearly, valuation matters.

History never repeats itself exactly. Technology stocks in 1999/2000 were truly in a league of their own with respect to overvaluation. As such, we certainly are not forecasting the NASDAQ to fall by over 50%. However, there are many parallels to that period of 20 years ago and a much less dramatic version of events is entirely possible. Therein lies the opportunity.

Company Spotlight

Stanley Black & Decker

Stanley Black & Decker is a manufacturer of industrial tools and household hardware and provider of security products. The firm is benefitting from two powerful tailwinds; demographics and the environmentally friendly move to electrification. Overall market weakness and temporary supply chain issues have created the opportunity to take a position in a high-quality company that will continue to grow its dividend.

After five years of share gains, the tool market has essentially turned into a two-horse race. Stanley is the leader with brands like Stanley, Black and Decker, DeWalt and Craftsman. Stanley has three times the e-commerce business of its next-largest competitor and has set up its sales platform well for future growth. Sales accelerated during the pandemic due to house purchases and do-it-yourself projects. Beyond the pandemic, these trends should remain in place due to the strong demographic trends of millennials buying homes. With respect to the move to electrification, tools that run on batteries are less noisy and noxious than gasoline-powered tools. It is expected that regulations will eventually limit or ban gasoline lawn and garden equipment.

Closing Comments

While asset markets have come a long way over the past 18 months, we maintain our view that:

1.Despite many pockets of overvaluation, there are still decent investment opportunities available; and

2.The global economy will continue to gradually (if erratically) improve.

With respect to the first point, we have elaborated on some investment opportunities and themes earlier in this newsletter. When it comes to the economy, it is important to note that just one year ago, many investors refused to believe the recession was over, and some pundits were even loudly predicting a global depression as a result of the pandemic. Fast forward to today and we are instead witnessing severe bottlenecks in the economy as supply chains strain to meet the robust demand for many goods and services.

Figure 4 below is a satellite image of the port of Los Angeles, where wait times to offload containers have caused an unprecedented backlog of ships at anchor. There may be issues with the economy at the present time, but demand does not seem to be one of them.

The new concern with respect to the economy is the potential for inflation. We do not pretend to know the likelihood of a sustained period of higher prices. However, it is possible. As such, we are committed to structuring client portfolios to be able to withstand this potential threat. Our full breadth of investment strategies were designed partly with this thought in mind (particularly the private funds).

On a related note, we would like to acknowledge Mike Kosmalski’s leadership on one of the strategies, the Credit Opportunities Fund, which was nominated for fund of the year in the credit category by an industry organization. We have just witnessed a year of rising interest rates and their associated negative effect on fixed income, and the Credit Opportunities Fund more than admirably performed its function in client portfolios.

A final note on taxes: Over the past 12 months, many of our equity positions hit their target prices earlier than we anticipated. Our valuation and risk control discipline ensured that we redeployed the proceeds into better risk/reward opportunities. The good news: returns have been strong. It has also resulted in a higher than usual amount of taxable gains being generated. However, with governments signaling that capital gains inclusion rates are likely to head higher in a post-COVID world, there may actually be a benefit to paying taxes sooner rather than later.