Our succinct perspective on key investment and wealth-related issues.

Five key takeaways from our “Macro meets Micro” evening with David Rosenberg and Jeff Hales

Last week we welcomed our clients and friends to the Park Hyatt for a lively discussion between economist and founder of Rosenberg Research, David Rosenberg and Focus’ own portfolio manager, Jeff Hales, CFA.

Entitled “Macro meets Micro”, the conversation highlighted the most pressing economic themes facing Canadian investors, as well as current investment risks and opportunities.

Between inflation, interest rates, geopolitical risk and the looming US election, Rosenberg and Hales left few stones unturned. Perhaps the greatest takeaway of all, however, was the need for investors in this environment to actively manage valuation risk—something both Rosenberg and Hales agreed was, if managed poorly, a major potential hurdle to future returns.

Five key takeaways from the event (in graphs):

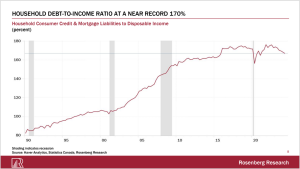

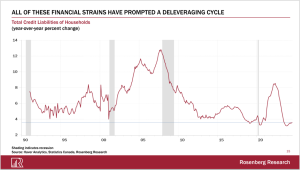

Canadian consumers still face an excessive debt burden

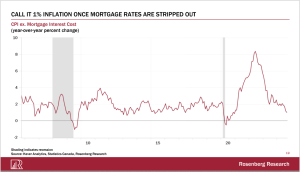

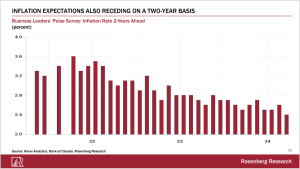

Yet, ex-mortgages, Canada’s inflation story is, surprisingly, not terrible

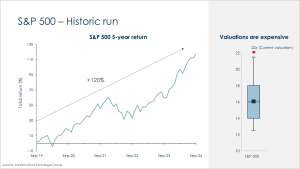

Meanwhile, the broad US equity market has had a huge run and now trades at historically expensive valuations

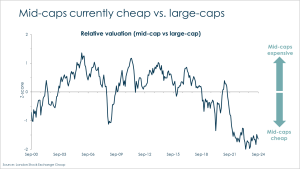

Nonetheless, there remain opportunities for active investors, in particular in mid-cap stocks and Canada

Full video

For a full video replay of the event, please click here.